As an expansive digital realm, Facebook thrives, hosting innumerable dialogues amongst a population that rivals some of the world’s largest nations.

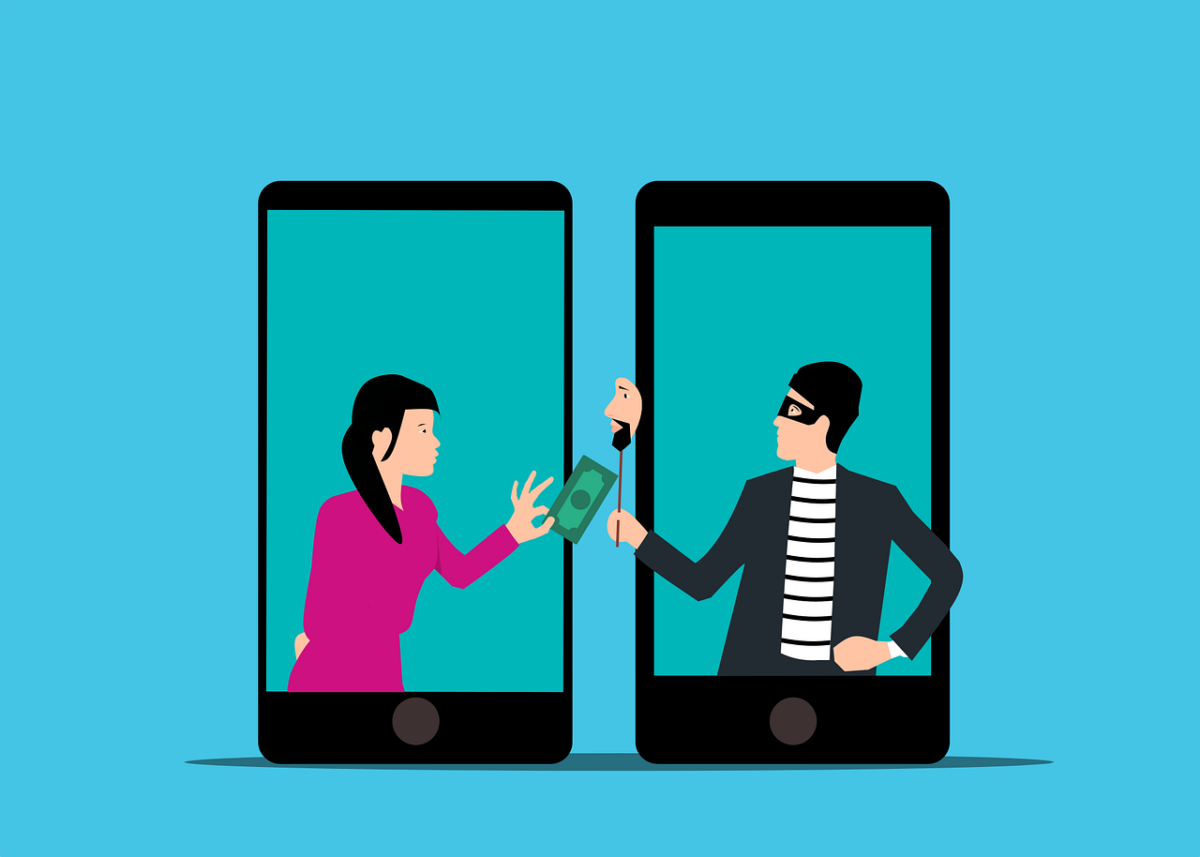

Still, this digital utopia encounters an unfortunate side effect of its size and influence: increased instances of duplicitous dealings.

Unwitting victims are ensnared by malevolent actors promising illusory rewards – from nonexistent investments to fabricated prizes.

Among the many questions victims face, how to get money back from Facebook scammer is often paramount.

This piece delves into the labyrinth of retracing pilfered funds from Facebook’s elusive tricksters, employing a meticulous, robust judicial pathway that is equally compelling and proficient.

Post Contents

Step 1: Gather Evidence

Embarking on the quest to reclaim your assets from a Facebook swindler? Step one involves the meticulous aggregation of every shred of evidence.

Think screenshots bearing the watermark of deceitful dialogues, intel on the scammer’s digital persona, or the paper trails left by monetary transactions.

Preserve an unbroken log of every encounter with your digital adversary. This archive, a beacon of clarity in a storm of confusion, offers vital assistance in pinpointing the fraudster’s identity and fortifying your subsequent legal endeavors.

Thus, we chart a course to snatch back your hard-earned cash from Facebook’s realm of duplicity.

Step 2: Report The Scammer To Facebook

After you’ve compiled all necessary proof, your next task is to alert Facebook about the fraudster’s actions.

Facebook adheres to a stringent policy concerning fraudulent activities, ceaselessly working to maintain the safety of its user-centric platform.

While addressing your report, Facebook scrutinizes the details, potentially implementing preventative steps to hinder the scammer from further victimizing users.

Nevertheless, an essential point to keep in mind is that Facebook, while capable of stalling the fraudster’s activities, doesn’t possess the means to recover your lost funds.

Step 3: Contact The Credit Institution Or Credit Card Company

Should the fraudster’s transactions have been completed using your credit card or through a bank transfer, make haste to get in touch with your bank or card issuing company.

They may possess the capacity to either stop the transaction or assist in recouping your funds.

Be aware, though, that the timeframe since the transaction and the specific policies of your financial institution could significantly influence these outcomes.

Step 4: File A Police Report

In the unfortunate event that your bank or credit card firm’s assistance couldn’t recover your funds, your subsequent course of action lies in alerting the law enforcement authorities about the scam.

The dossier of evidence you’ve collated will be required, and you should strive to furnish exhaustive details concerning the fraudulent scheme.

Occasionally, the tenacity of the police might indeed trace the scammer’s tracks, paving the way to regain your lost money.

Step 5: Consult A Lawyer

Facing extensive fraudulent activity, securing the services of a legal counsel becomes pivotal.

Lawyers adeptly steer through the labyrinthine legal terrain, offering strategic counsel to recuperate your funds.

The importance of selecting a lawyer boasting a track record in tackling online fraud and scams cannot be overstated.

Evading Scams On Facebook

Retrieving cash siphoned through a Facebook scam may often be a convoluted, time-consuming endeavor.

However, scam prevention leans more towards simplicity. Virtual vigilance is a must; never funnel money to unknown entities and consistently authenticate information before diving into a deal or investment.

Moreover, keeping abreast of the latest scam strategies on Facebook and the protective measures against them is vital.

Facebook provides a multitude of resources for scam deterrence, comprising guidelines to discern scams and report suspect fraudsters.

Here are some strategies for steering clear of Facebook scams:

- Cultivate a Skeptical Mindset: Extraordinary deals or offers often bear the hallmark of scams. Adopt a critical approach towards promotions, giveaways, or ‘too good to be true’ opportunities that tout massive returns for negligible effort.

- Authenticate the Origin: Prior to interaction, ensure the credibility of the individual or company. Scout for verification badges on business profiles and run an online check for potential negative feedback or scam warnings.

- Fortify your Account: Adopt robust, distinctive passwords and bolster security with two-factor authentication to safeguard your account from hacking attempts.

- Guard Personal Information: Sharing of sensitive personal or financial information over Messenger or in public posts is a definite no-no. Authentic organizations won’t solicit these details via Facebook.

- Unsolicited Contact – Handle with Care: Unexpected messages or friend requests, especially from unfamiliar sources, should be treated with suspicion.

- Invest in Knowledge: Facebook provides tools and resources to help users discern and avoid potential scams. Spend time to familiarize yourself with these.

- Spot Something Off? Report!: Any suspicious activity should be promptly reported to Facebook. User reports are integral to their effort to thwart scammers and preempt future scams.

Remember, the twin shields of vigilance and skepticism are your strongest protection against online scams. Make a habit of scrutinizing before clicking on a link or divulging information.

Conclusion

Sadly, scams on Facebook are more common than one would wish, but there exist strategies to reclaim your funds and safeguard against future scams.

The recovery process may stretch over time, and it may not always lead to success, but equipped with appropriate resources and legal backing, the path can be maneuvered successfully.

Above all, prevention is the ultimate defense against scams. Stay alert, informed, and never shy away from seeking assistance if you’ve fallen prey to a scam.

1 thought on “Navigating The Legal Process: How To Recover Your Money From A Facebook Scammer”

Recovering your money may be difficult or simple, depending on your circumstances, the proof you have, and the manner in which you were defrauded.

My recommendation is that you report your case to the authorities or your local law enforcement, explaining the scam you were duped and the difficulties you are facing. I want you to know that this doesn’t usually work out because law enforcement rarely helps victims get their money back. However, you can get help if you work with a legitimate recovery company, and one that I can recommend is Aceretrieve •com. You can visit their website, tell them how you were scammed, and explain your situation to them. They’ll let you know They will assist you if they are able to resolve your situation, and they will not take advantage of you—I know this since I have used their services.

Additionally, I’ll warn you to watch out for fraudulent recovery organizations on this platform, as they impersonate legitimate businesses and exploit victims. Do your homework before contacting any firm to avoid falling victim twice.