If you’re interested in investing in Amazon, buying its stock is one way to do so.

Amazon is one of the largest companies in the world, and its stock has consistently performed well over the years but how to buy Amazon stock?

Before you start investing, it’s important to understand the basics of how to buy Amazon stock.

To buy Amazon stock, you’ll need to open an online brokerage account.

There are many options available, and it’s important to choose one that meets your needs.

You’ll also need to decide whether you want to place a market order or a limit order.

A market order allows you to purchase the stock at its current price, while a limit order lets you set the maximum price you’re willing to pay for a share.

It’s important to research the stock and the company before making a decision, and to keep in mind that investing always carries some level of risk.

Post Contents

Understanding Amazon Stock

If you’re interested in investing in Amazon, it’s important to understand what Amazon stock is, why you should invest in it, and the different segments of Amazon’s business.

What is Amazon Stock?

Amazon stock (ticker symbol: AMZN) represents ownership in Amazon.com, Inc.

As an investor, when you buy Amazon stock, you’re buying a share in the company.

The value of your investment will go up or down based on the performance of Amazon’s business.

Why Invest in Amazon Stock?

Amazon is a well-known e-commerce giant that has been around since the mid-1990s.

Over the years, Amazon has expanded its business to include a variety of different segments, including Amazon Web Services (AWS) and Whole Foods Market.

As a result, Amazon has become a major player in several different industries, making it a potentially valuable addition to your investment portfolio.

Amazon’s revenue has continued to grow over the years, and the company has consistently beaten earnings expectations.

This is due in part to the fact that Amazon is constantly innovating and expanding its business.

For example, Amazon’s cloud computing business, AWS, has been a major profit driver for the company in recent years.

Amazon’s Business Segments

Amazon’s business is divided into several different segments, each with its own revenue stream.

Here are the main segments:

- North America: This segment includes Amazon’s U.S. e-commerce business, as well as Whole Foods Market.

- International: This segment includes Amazon’s e-commerce business in other countries.

- AWS: This segment includes Amazon’s cloud computing business.

- Advertising: This segment includes Amazon’s advertising business, which has been growing rapidly in recent years.

- Other: This segment includes Amazon’s non-core businesses, such as Zappos.

As an investor, it’s important to understand how each of these segments contributes to Amazon’s overall business.

This can help you make informed decisions about whether to buy, hold, or sell Amazon stock.

When investing in individual stocks like Amazon, it’s important to remember that there are risks involved.

Amazon’s stock price can be affected by a variety of factors, including changes in the economy, demand for Amazon’s products and services, and competition from other retailers.

It’s important to diversify your investment portfolio and consult with a tax professional to understand how capital gains taxes may affect your investments.

Overall, Amazon stock can be a valuable addition to your investment portfolio if you’re looking for long-term growth potential.

With its strong financials and diverse business segments, Amazon is a company that is worth considering for investors who are interested in the stock market.

How to Buy Amazon Stock

If you’re interested in buying Amazon stock, there are a few steps you need to take.

Choose a Brokerage Account

To buy Amazon stock, you’ll need to open an online brokerage account.

There are many options available, including commission-free trading platforms.

Some popular options include Robinhood, E*TRADE, and TD Ameritrade.

Before choosing a brokerage account, it’s important to consider factors such as fees, account minimums, and investment options.

You may also want to consider working with a financial advisor to help you make informed investment decisions.

Research Amazon Stock

Before investing in Amazon stock, it’s important to research the company’s historical performance and financials.

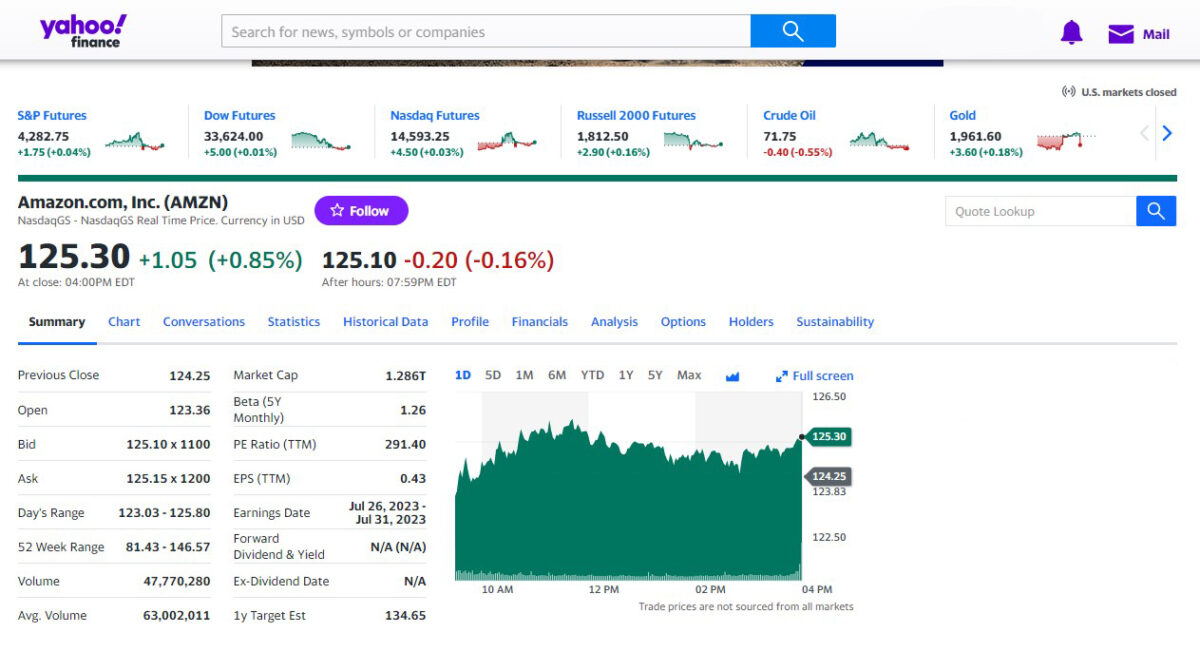

You can find Amazon’s current stock price by searching for the company’s trading ticker, AMZN, on a financial information website or app.

You may also want to consider factors such as Amazon’s position in the NASDAQ 100 and its inclusion in exchange-traded funds (ETFs).

It’s important to understand the risks and potential rewards of investing in Amazon stock before making a purchase.

Place an Order

Once you’ve chosen a brokerage account and researched Amazon stock, you’re ready to place an order.

You can place a market order, which allows you to purchase the stock at its current cost, or a limit order, which allows you to set the maximum price you’re willing to pay for a share.

When placing an order, be sure to double-check the details, including the number of shares you want to purchase and the order type.

Once your order is filled, you’ll officially own shares of Amazon stock.

Buying Amazon stock requires opening an online brokerage account, researching the company’s historical performance and financials, and placing an order.

By following these steps and making informed investment decisions, you can potentially benefit from the growth of one of the world’s largest companies.

Factors to Consider Before Buying Amazon Stock

Before investing in Amazon stock, there are several factors that you should consider to make an informed decision.

Here are some key factors to keep in mind:

Amazon’s Financials

Analyzing Amazon’s financials is crucial before buying its stock.

You can find this information on Amazon’s investor relations website or financial news websites.

Look for metrics such as revenue growth, net income, and earnings per share (EPS) to get a sense of the company’s financial health.

It’s also important to consider Amazon’s debt levels and cash flow.

High levels of debt can be a red flag, while strong cash flow can indicate that the company has enough liquidity to weather economic downturns.

Amazon’s Competitors

Amazon faces competition from a variety of companies in different industries.

When considering Amazon’s stock, it’s important to analyze the competitive landscape.

Some of Amazon’s main competitors include Walmart, Alibaba, and eBay.

Look at how Amazon’s competitors are performing financially and what strategies they are using to compete with Amazon.

This can help you evaluate Amazon’s position in the market and its potential for growth.

Investment Goals

Before buying Amazon stock, consider your investment goals.

Are you looking for a long-term investment or a short-term gain?

Are you willing to take on more risk for potentially higher returns, or do you prefer a more conservative approach?

Your investment goals should align with your risk tolerance and financial situation.

Consider factors such as your age, income, and other investments when deciding how much to invest in Amazon stock.

Risk Tolerance

Investing in the stock market always carries some degree of risk.

Before buying Amazon stock, assess your risk tolerance.

How much risk are you willing to take on?

Consider how much you are willing to lose if the stock price drops and how much time you have to recover from potential losses.

It’s important to have a clear understanding of your risk tolerance before making any investment decisions.

Key Takeaways

When it comes to buying Amazon stock, here are a few key takeaways to keep in mind:

- You will need to open a brokerage account in order to buy Amazon stock. Take some time to research different brokerages and investment platforms to find the one that is right for you.

- Before making any purchases, it’s important to evaluate Amazon’s financials and related news to determine whether the stock is a good investment opportunity for you.

- When placing a trade, you will need to use the Amazon ticker symbol, which is AMZN.

- Your trade will fall into one of two categories: market order or limit order. A market order allows you to purchase the stock at its current cost, while a limit order allows you to set the maximum price you’re willing to pay for a share.

- Keep in mind that buying stocks always comes with some degree of risk. It’s important to do your own research and make informed decisions based on your own financial goals and risk tolerance.

By keeping these key takeaways in mind, you can make a more informed decision about whether buying Amazon stock is the right choice for you.

Remember to always do your own research and make informed decisions based on your own financial goals and risk tolerance.