Are you interested in investing in Amazon stock? One of the first things you’ll want to know is Amazon stock.

As of June 2023, Amazon’s stock price is listed at $125.30 per share on Google Finance.

However, it’s important to keep in mind that stock prices can fluctuate frequently based on a variety of factors.

If you’re considering investing in Amazon, it’s important to do your research and understand the risks involved.

While the company has experienced significant growth in recent years, there’s no guarantee that this trend will continue.

It’s also important to consider your own financial situation and goals before making any investment decisions.

With careful consideration and a bit of luck, investing in Amazon stock could potentially be a wise decision for your portfolio.

Post Contents

How Much is Amazon Stock?

If you are interested in trading Amazon stock, it’s important to know how much it is currently worth, how it has performed historically, and what factors can affect its price.

In this section, we will cover all of these aspects to give you a better understanding of Amazon’s stock.

Current Stock Price

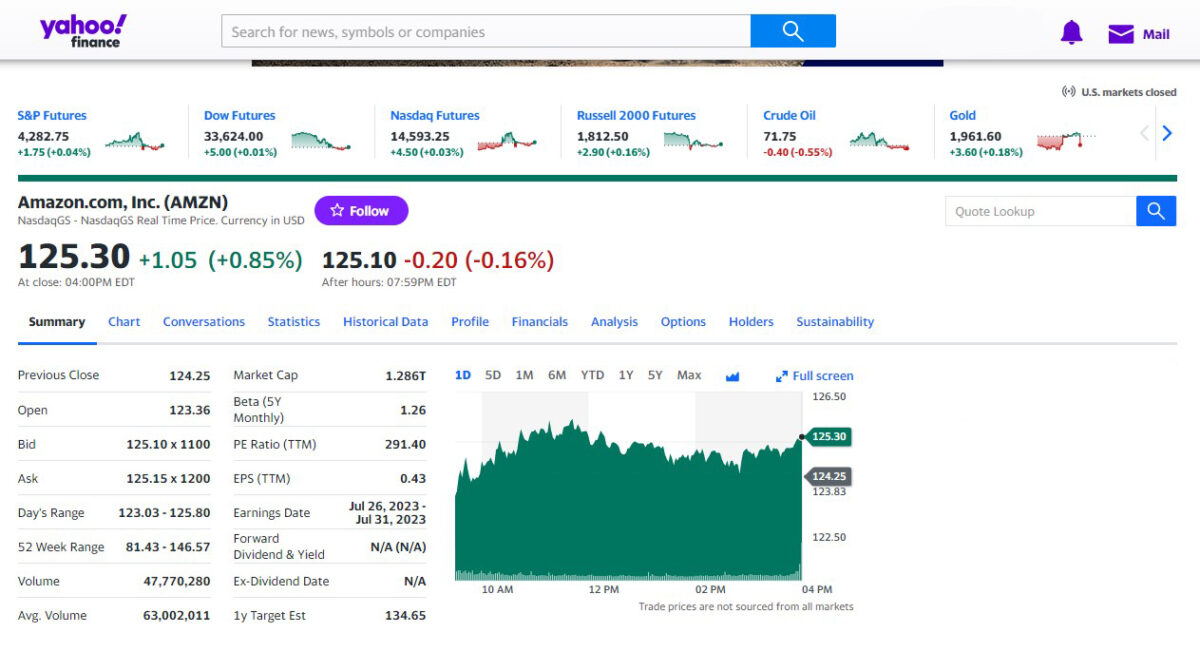

As of today, June 5th, 2023, Amazon’s stock (AMZN) is priced at $125.30 per share.

This is the current market value for one share of Amazon, and it is subject to change throughout the trading day.

You can find the most up-to-date stock price on various financial websites, such as Yahoo Finance, Google Finance, or Nasdaq.

Historical Performance

Amazon has a long history of strong performance in the stock market.

In the past decade, its stock price has risen from around $100 per share to over $3,000 per share.

However, like any stock, Amazon’s price has also experienced fluctuations and volatility.

For example, in March 2020, during the COVID-19 pandemic, Amazon’s stock price dropped by over 20% in just a few weeks.

Factors Affecting Stock Price

Amazon’s stock price is affected by many factors, including its financial performance, market trends, and global events.

Here are some of the most important factors that can influence Amazon’s stock price:

- Revenue and profits: Amazon’s financial performance is a major driver of its stock price. When the company reports strong revenue and profits, investors are more likely to buy its stock, which can drive up the price.

- Competition: Amazon faces intense competition in many of its markets, such as e-commerce and cloud computing. If competitors like Walmart or Microsoft gain market share, it can negatively impact Amazon’s stock price.

- Global events: Amazon operates in many countries around the world, and global events like economic downturns, political instability, or natural disasters can impact its stock price.

- Acquisitions and partnerships: Amazon has made many strategic acquisitions and partnerships over the years, such as its acquisition of Whole Foods or its partnership with Alphabet’s Google. These moves can impact investor sentiment and affect the stock price.

- Technology trends: Amazon is a technology company at its core, and new trends like artificial intelligence or blockchain can impact its business and stock price.

Investing in Amazon stock can be a smart move for those interested in the retail, logistics, or technology sectors.

However, it’s important to keep in mind the risks and volatility associated with any stock investment.

If you’re interested in buying Amazon stock, consider opening a brokerage account and placing a market or limit order to purchase shares.

You can also invest in Amazon indirectly through exchange-traded funds (ETFs) or mutual funds that hold Amazon stock.

Investing in Amazon Stock

If you are interested in investing in Amazon stock, there are a few things you should consider before making the decision to buy.

Here are some important factors to keep in mind:

How to Buy Amazon Stock

To buy Amazon stock, you will need to open a brokerage account with a reputable online broker.

Once you have funded your account, you can place an order to buy Amazon stock using either a market order or a limit order.

Market orders are executed at the current market price, while limit orders allow you to specify the maximum price you are willing to pay for the stock.

Risks and Benefits of Investing in Amazon Stock

Like any investment, buying Amazon stock comes with both risks and benefits.

On the one hand, Amazon has a proven track record of success in the e-commerce industry and has diversified into other areas such as cloud computing with Amazon Web Services (AWS).

On the other hand, the stock price can be volatile and subject to market fluctuations.

Amazon faces competition from other retailers such as Walmart and increasing scrutiny from regulators.

Comparison to Other Technology Companies

Amazon is one of the largest and most successful technology companies in the world, but it is not the only one.

Other technology companies such as Microsoft and Alphabet (Google) also offer opportunities for investment.

When considering investing in Amazon, it can be helpful to compare its financials and valuation to those of other companies in the same industry.

Amazon’s Business Operations

Overview of Amazon’s Business Model

Amazon.com is an e-commerce giant that offers a wide range of products and services to customers worldwide.

The company’s business model is based on providing customers with a convenient and seamless shopping experience, which has helped it become one of the world’s largest online retailers.

Amazon’s business operations are divided into two main segments: North America and International.

The North America segment includes the United States and Canada, while the international segment includes all other countries where Amazon operates.

Amazon’s Revenue Streams

Amazon generates revenue through a variety of sources, including online retail shopping, third-party seller services, and subscription services such as Amazon Prime.

The company also generates revenue through Amazon Web Services (AWS), which provides cloud computing services to businesses and individuals.

Amazon Web Services (AWS)

AWS is a subsidiary of Amazon that provides cloud computing services to businesses and individuals.

AWS offers a wide range of services, including storage, computing, and database management, among others.

AWS has become a significant revenue stream for Amazon, accounting for a significant portion of the company’s profits.

Logistics and Distribution

Amazon’s logistics and distribution network is a critical component of its business operations.

The company has invested heavily in building a robust logistics and distribution network that allows it to provide fast and efficient delivery to customers worldwide.

Amazon’s distribution network includes a vast network of fulfillment centers, distribution centers, and delivery stations.

Amazon’s business operations are vast and diverse, with multiple revenue streams and a robust logistics and distribution network.

The company’s focus on providing customers with a seamless shopping experience has helped it become one of the world’s largest online retailers.

With the continued growth of e-commerce and the increasing adoption of cloud computing services, Amazon’s position as a leading technology company is likely to continue for years to come.

Key Takeaways

If you’re considering investing in Amazon stock, there are a few key takeaways to keep in mind.

First, Amazon is a massive company with a market capitalization of over $1.5 trillion.

As of June 5, 2023, Amazon’s stock price is $3,524.12 per share.

This means that buying even a single share of Amazon stock can be a significant investment.

Second, Amazon has a history of growth and innovation.

The company has diversified from its roots as an online retailer to become a major player in cloud computing, streaming services, and more.

While there are always risks associated with investing, Amazon’s track record suggests that the company is well-positioned for continued success in the years to come.

Third, it’s important to keep an eye on Amazon’s financials and earnings reports.

As of April 2022, Amazon’s Web Services (AWS) revenue surpassed analyst expectations, reaching $18.4 billion for the quarter.

However, the company’s third-quarter results and outlook were disappointing, leading some analysts to cut their fair value estimates for Amazon stock.

Ultimately, investing in Amazon stock can be a smart choice for those willing to take on some risk in pursuit of potential rewards.

However, it’s important to do your research and keep an eye on the company’s financials and performance over time.