When it comes to trading, it’s pretty common to have a good scalping strategy. Scalping can be defined as a trading style that has a special focus on making a profit while making the most of minuscule price changes in CDFs or Forex trading. Traders can enter and exit their trading position within a tight timeframe – within seconds and minutes, and use a number of different scalping methods to make a profit.

Let’s take a look at what you need to know about scalping so that you can come up with the best strategy in the game.

Post Contents

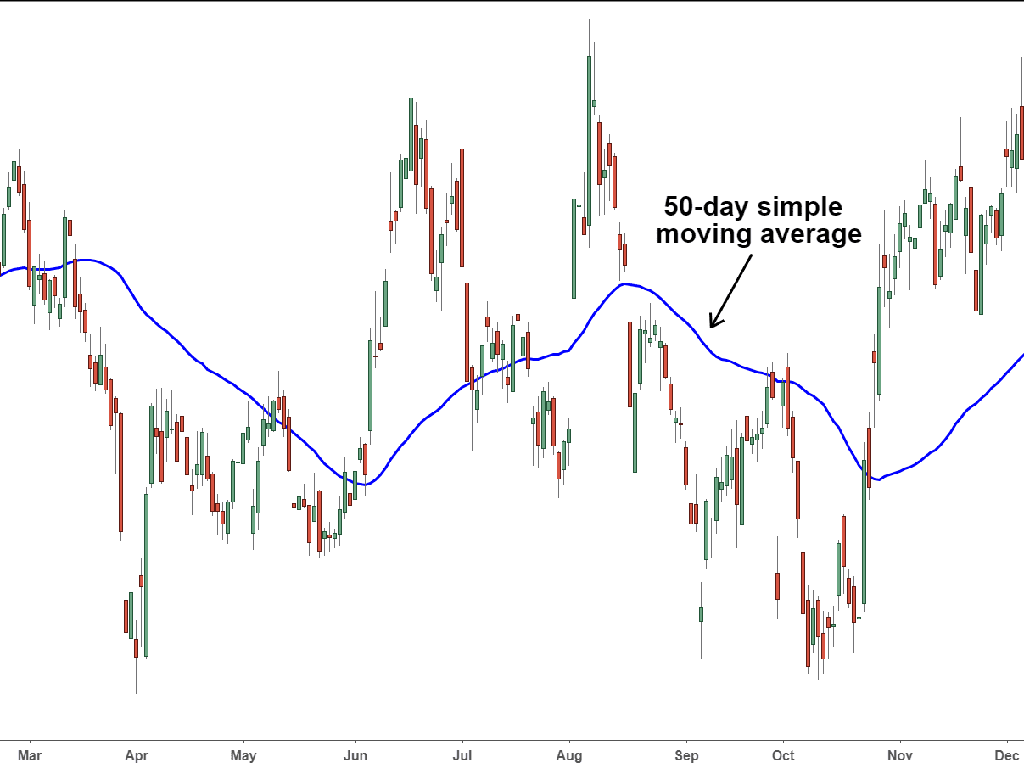

1. Simple Moving Average Indicator

A simple moving average indicator, or SMA, is a tool that you can use to put a simple strategy together to make things a bit easier. An SMA will show you the average price within a specific time, which means that you get to understand whether a price is increasing or decreasing so that you can see if there’s a trend or not.

This moving average will help you work out recent closing prices and divide them by the amount of periods in the average of the calculation. It’s a great way to build your DAX scalping strategy. Just remember that short-term averages are best for reacting fast, while long-term averages are best for reacting slower.

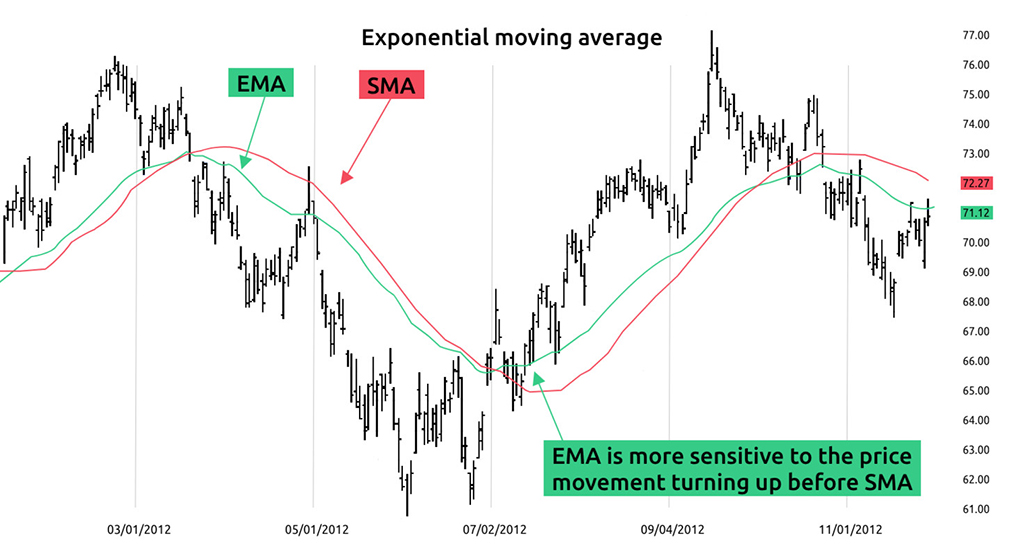

2. Exponential Moving Average Indicator

Another helpful indicator is the EMA, which can give more weight to recent pricing. This means that it has a quicker reaction time to price changes that are recent, as opposed to older ones.

This is used by traders everywhere to buy and sell signals that stem from divergences and crossovers obtained through historical averages.

For technical analysis, both EMA and SMA are helpful, as long as you can interpret, apply, and calculate them the right way. They will help you to work out the strength of the market.

3. Average Convergence Divergence Indicator

The next scalping indicator, the MACD, is a lot more than just a scalping indicator. It is a tool that can be used by traders who need a diverse approach and style for everything. In fact, it is the best tool in the market for capturing trends and understanding momentum. The MACD can indicate the relationship between the two MAs in a security price.

You can work out the MACD by taking away the 26 day EMA from the 12 day. The signal line or the default setting of MACD is the 9 day EMA. This will be plotted on top of the MACD.

However, before you dive into using MACD, make sure that you learn all about divergence and convergence.

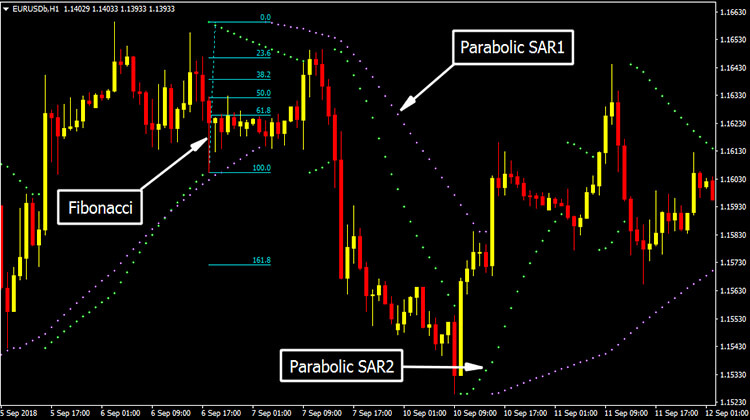

4. Parabolic SAR Scalping Indicator

The SAR scalping indicator is the best way to see a price action trend. If the trend of the price goes on an upwards trajectory, then the SAR will put chart points below the pricing. The same thing happens when the pattern goes on a downward trajectory, except the opposite – they will be above the price.

Traders make the most of a tool like this to help work out short-term momentum with an asset so that they can place stop-loss orders where applicable. You need to use a tool like this in markets that show steady trends.

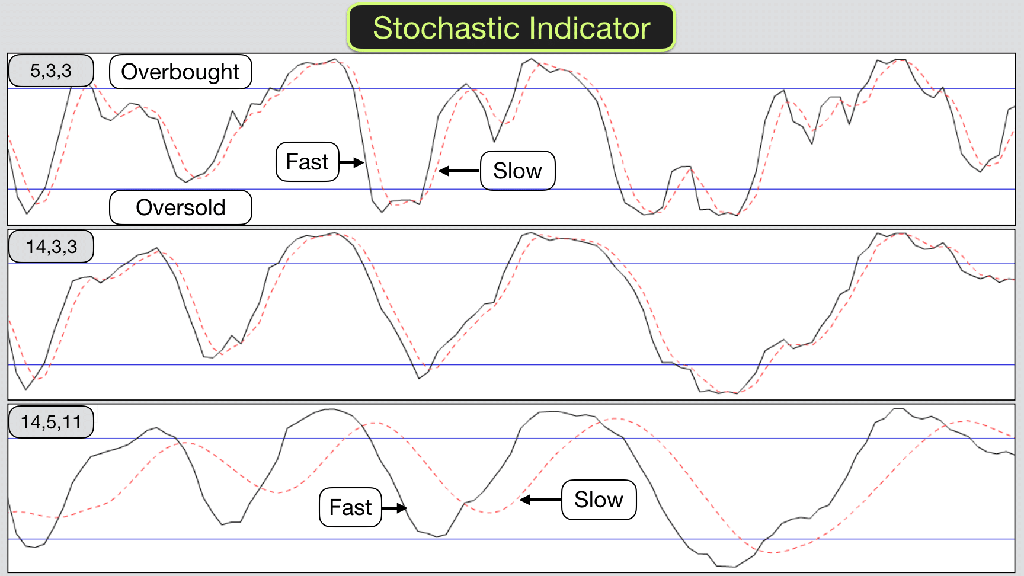

5. Stochastic Oscillator Indicator

The last tool that you can use for scalping is also one of the most popular choices for traders. It can be used with Indices, Forex, and CDFs. It’s a momentum indicator that follows a pretty simple premise. The momentum precedes the price, which means that traders use this tool to work out the signal of the movement, right before it happens.

Another thing that it can do is identify closing prices that are trading at the high end of the price action. Whether you understand the intricacies of this type of scalping tool or not, it’s well known for being reliable. It can also measure the relationship between the price range of an asset and the closing price of the asset, over any given period.

It’s a great way for scalpers to identify those major turning points in the market with the utmost precision so that they don’t miss their shot.

Final Thoughts

As well as profound knowledge, scalping strategies require traders to have a huge amount of experience with using trading platforms. However, no matter how successful your scalping strategy is, you need to take a realistic approach to the market. Never trade on CDFs, Forex, or Indices without a stop-loss order – it’s that simple.