The retirement landscape has significantly transformed in recent years, challenging the once-standard vision of bidding adieu to the workforce by 60.

Historically, this milestone marked the transition from a life of labor to leisure and relaxation.

Retirees expect to enjoy their golden years supported by pensions, savings, and social security. However, recent years have painted a different picture, one where the reality of retirement has markedly changed.

Research underscores this shift, revealing the number of people aged 60 and older in the workforce doubled between 2000 and 2020. This trend is not solely driven by a desire to stay active or engaged.

Instead, it’s necessary for many who find that their retirement savings fall short of providing a sustainable income.

The escalating cost of living, healthcare expenses, and the population’s longevity have all contributed to the financial strain on retirees.

Moreover, the concept of unretirement is becoming increasingly common. A survey found that almost 20 percent of retirees are employed, and seven percent actively seek employment. These individuals often cite financial need as the primary reason for their return.

This shift in retirement dynamics underscores the urgency for strategic financial planning and saving. Reaching retirement age without sufficient funds to support a lifestyle prompts reevaluating how to approach retirement savings.

An Individual Retirement Account (IRA), primarily online, emerges as a critical tool in this landscape.

Offering flexibility, lower fees, and a wide array of investment options, online IRAs represent a modern solution to an age-old challenge. Individuals can take control of their financial future and work towards a retirement that aligns with their aspirations and needs.

Post Contents

Benefits Of Opening An Online IRA

The shift towards digital finance has brought about a revolution in how we approach retirement savings. Opening an online IRA account comes with many benefits catering to the modern investor’s needs.

With an online IRA, your retirement savings are just a few clicks away. This convenience allows for regular monitoring and adjustments to your investment strategy, ensuring it aligns with your financial goals.

Moreover, online platforms often have lower overhead costs than traditional brick-and-mortar institutions, translating into reduced fees for account holders.

Investment Options For Online IRA

An online IRA opens the door to a diverse array of investment options. You can customize your retirement portfolio to your risk tolerance and financial goals. Some of the online IRA options one can explore include:

- Stocks and bonds: Direct investment in stocks and bonds offers the potential for high returns, albeit with higher risk.

- Mutual funds and ETFs: These provide an avenue to put money in a diversified portfolio of bonds or stocks managed by professionals, often with lower risk.

- Real estate investment trusts (REITs): For individuals interested in property assets, REITs offer a way to invest in property without directly buying or managing it.

- Certificates of deposit (CDs) and money market funds: These options offer lower risk and stable returns for a more conservative investment.

Tips For Maximizing Retirement Savings

To make the most of your online IRA, consider these strategic tips:

Start Early And Contribute Regularly

The principle of compounding interest is akin to a snowball rolling downhill. The sooner it starts, the larger it grows.

Beginning your retirement savings early in your career allows your investments more time to grow, benefiting from the compound interest.

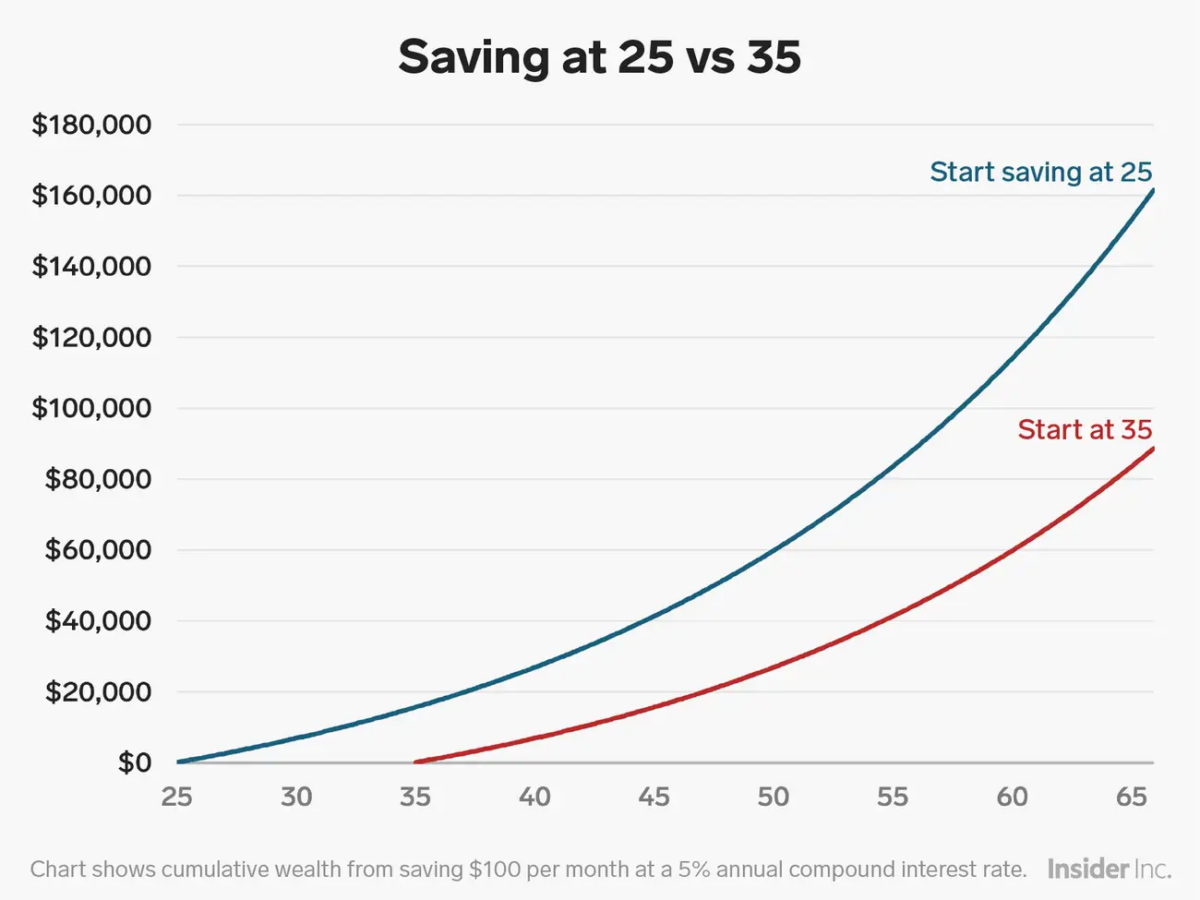

For instance, there’s a dramatic difference in retirement savings between individuals who save at age 25 versus those who start later.

The earlier group can end up with nearly double the savings at retirement, even if they contribute the same amount monthly.

Regardless of the market’s condition, consistent contributions can also play a crucial role.

This practice, known as dollar-cost averaging, helps mitigate the risk of market changes by spreading out your investment purchases over time. It could lower the average cost per share of your investments.

Take Advantage Of Tax Benefits

Each type of IRA comes with specific tax advantages that can significantly impact your retirement savings strategy.

Traditional IRAs offer tax-deductible contributions, meaning the amount you contribute may be subtracted from your annual taxable income. However, taxes on withdrawals in retirement are at your future tax rate.

Conversely, Roth IRAs provide tax-free growth and withdrawals in retirement. It’s beneficial for those who expect to be in a higher tax bracket during retirement.

Diversify Your Portfolio

The adage “Don’t put all your eggs in one basket” applies when it comes to retirement savings. Diversification across different asset classes can reduce the risk of significant losses if one investment option performs poorly.

A well-diversified portfolio can minimize risk while maintaining potential returns. Including a mix of assets can balance out the volatility of stocks with the steadiness of bonds, for example. It will also help to tailor your portfolio to your risk tolerance and retirement timeline.

Monitor And Adjust

The financial market is dynamic and highly sensitive to economic, political, and social factors. Review your retirement plan annually, with adjustments made as necessary to reflect current market conditions and personal circumstances.

Craft A Future Of Financial Security

An online IRA is more than just a retirement savings account. When used wisely, it can pave the way for a financially secure retirement.

Remember, the best time to plan for retirement is now. With the right approach and an online IRA as your ally, a comfortable retirement is within your reach.