Starting a business can be both exciting and stressful for owners. Establishing credit with vendors can be a challenge when you first start your business, as you will have no credit listings with which to be evaluated by lenders.

While most small business owners fund their startup costs using personal credit cards and loans, establishing a credit rating under your business name is the best way to grow and care for your business. The early days of your business are the right time to start building your professional credit rating.

Young businesses and startups are often required to sign a personal guarantee that a loan will be covered. However, as you begin to build credit with your vendors, you will be able to let your business stand on its own merits without this type of guarantee.

There are several ways to start building your business credit, including learning about the best tradeline companies. Let’s look at a few of the options that small business owners have that help them build a professional credit history.

Post Contents

Pay Your Bills Early

Paying your bills on time is one way to build a good credit history, but taking it one step further and paying your bills early can give you a boost. You will be gaining an excellent professional reputation with vendors as a consistent and reliable customer. You may also be able to qualify for discounts when you pay your accounts early. Paying your bills early guarantees that you will never have to pay out late fees or service charges on your accounts.

Incorporate Your Business

To help build your company credit rating, you need to be recognized as a business by both the IRS and credit bureaus like Equifax and Dun & Bradstreet. You will need to register your business as an individual corporate entity with a proper address and phone number to receive your EIN (Employer Identification Number) from the government.

Your EIN will act as an identification with the IRS and other governmental bodies. This will allow you to begin building a credit history in the name of your business rather than a personal account. Having your EIN will allow you to open a business bank account and apply for credit.

Business Tradelines

There are some advantages to using Authorized Tradelines to help grow your business credit; however, this option should be carefully considered. Each entry on your credit history is referred to as a “tradeline.” When you are just starting, your record may be pretty bare. You can pay a fee to “borrow” the excellent standing of another credit tradeline to help build your score.

For example, you may buy a tradeline for a business credit card that belongs to another account. You will be authorized to use this credit but have no actual access to funds. Essentially you are paying for borrowing someone else’s good credit history to boost your score. Talk to your financial advisor about finding a reputable tradeline company.

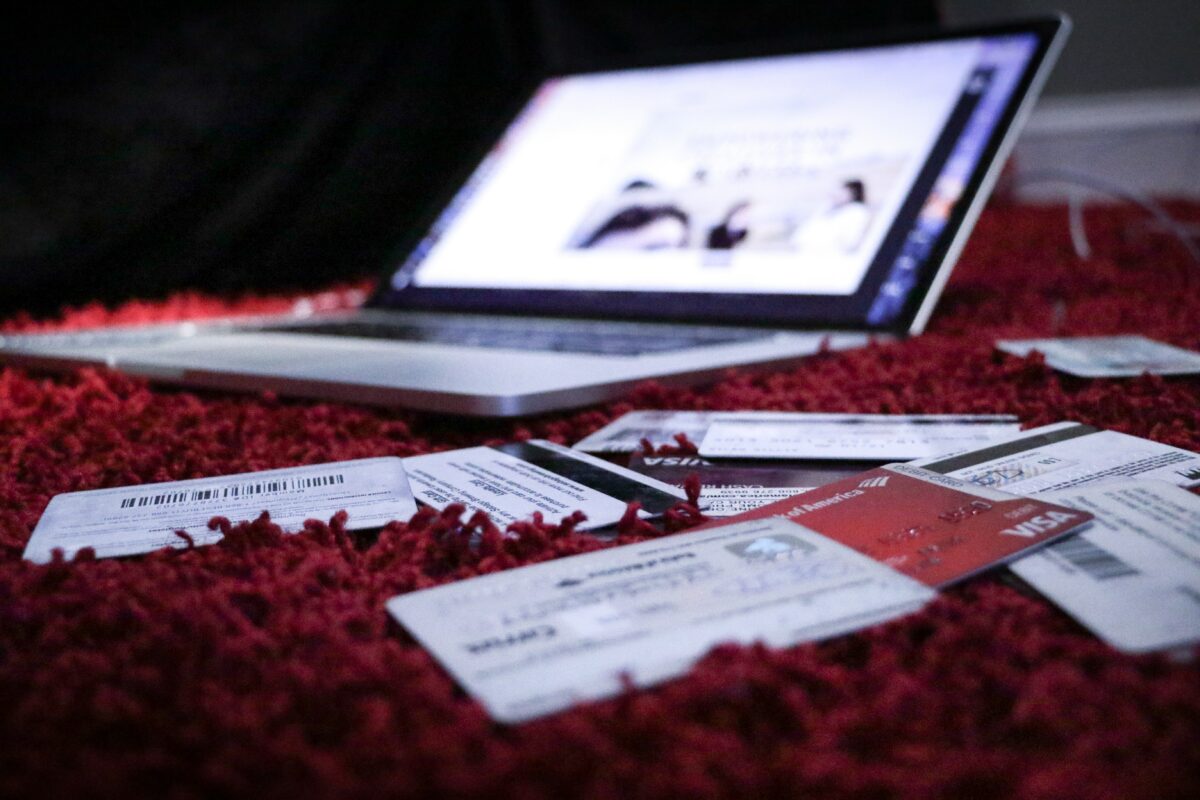

Apply for a Business Credit Card

Using a business credit card to make purchases for your business is an effective way to build your credit history. You can quickly establish that you have a good payment history and qualify for more significant loan amounts faster. When you use a business credit card, you can expand your cash flow, making it easier to operate your business. You can also earn rewards using your business credit card that can reduce your operating expenses.

Starting a business can be challenging, especially when you have no credit history to fall back on. Try out these strategies to help you build credit for your small business and work towards success.