Price fluctuations in Forex and other financial markets depend on several main factors.

These include supply and demand, the actions of market makers, as well as the news background.

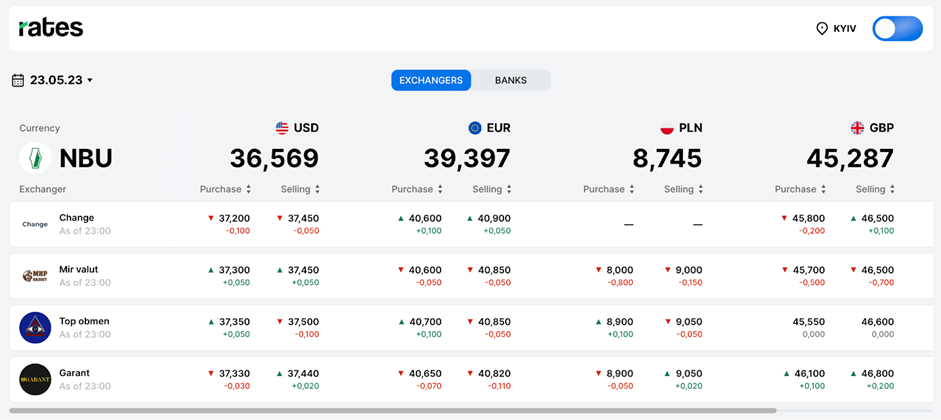

In this article, we will take a detailed look at all the main factors that affect the price. You can track fiat currency quotes using the Rates service.

Post Contents

Supply And Demand

In 2023, the top three most popular Forex currency pairs are EUR/USD, USD/JPY, and GBP/USD.

Anyone who wants to succeed in Forex should be aware of the factors that affect price fluctuations and exchange rates.

It is believed that supply and demand are the main drivers of price changes. The first is buying and the second is selling.

Supply and demand are not static in financial markets. They are in constant dynamics and price movements depend on changes in these parameters.

Growing demand for currencies and other assets drives up their prices. When we see an upward trend on the chart, it means that the interest of market players in the asset is high. At the same time, supply during an uptrend is below demand.

During periods of downtrends, demand is usually lower and supply substantially exceeds it. When the market is flat, supply and demand are in balance.

Forex News And Trading

The most important factor influencing supply and demand is news. During such periods, the market revives and local trends appear or volatility increases. Moreover, all news can be divided into three categories:

- Important events. These include GDP data, business activity indices, labor market, and inflation statistics, central bank meetings, rate, and monetary policy decisions, speeches by central bankers and leading politicians (for example, representatives of JPMorgan Chase, Wells Fargo & Company, Aflac, Binance, etc).

- Events of medium importance. This includes data on retail sales, indexes of consumer confidence and business confidence, and statistics on business activity in the construction sector.

- News of minimal importance. This category includes data on the budget balance, exports and imports, final statistics on business activity or GDP indices (as they usually correspond to preliminary estimates and do not affect the price), real estate price indices, and so on.

The news of the first category has the greatest influence on supply and demand. Usually, they cause strong market fluctuations.

Actions Of Market Makers

Market makers are liquidity providers. It is they who control the flow of quotes. First of all, let’s figure out who can be classified as a market maker.

This group includes banks, various financial companies and funds, and brokerage companies. It is they who collect orders from buyers and sellers, ensuring the operation of the market.

Market makers can have a serious impact on the market, as they have large financial resources.

Unlike individual traders and small financial companies, market makers can have millions of US dollars in a position. Such volumes can really move the price.

Not all brokers are market makers. Classic brokerage companies are just intermediaries between investors/traders and liquidity providers.

So, they do not have any effect on quotes. Although sometimes such firms enter the market with their positions for the purpose of speculation and investment.

So-called dealing centers are market makers for their clients. That is, they do not withdraw positions to external counterparties but process them internally, providing, if necessary, liquidity for the execution of all orders.

Such market makers can play against their clients and moreover, very often they do it. This is especially true for short-term trading when the account goes to points.

Dealing centers are well aware of where their clients’ stop orders are located. This allows them to manipulate the price, resulting in losses for traders.

Market makers have a serious influence on price fluctuations. In fact, their money is the basis of any trend or its stop.

The appearance of a major player in the market, such as a strong market maker, can at any moment reverse any trend or continue it with even greater force.

Market Noise

Price fluctuations are not always directional. On smaller time frames, you can see how orders placed by various market participants create the so-called market noise.

These are small price fluctuations in different directions, which greatly interfere with the analysis.

In order to avoid the influence of market noise on trading, they usually switch to higher time frames.

For example, on the daily charts, market noise is no longer visible. On sentries, it is still present, but less noticeable.

How To Identify Price Fluctuations

Whether you’re from Chicago (Illinois) or Los Angeles (California) in the USA, you can determine price fluctuations yourself.

To do this, there are several methods and many tools. Market fluctuations in general can be predicted using fundamental and technical methods of analysis.

The first allows you to evaluate the prospects of a particular currency based on macroeconomic data and decisions of the Central Bank, and the second works with a chart, indicators, as well as various graphic objects.

Interestingly, these methods are also used to analyze the dynamics of cryptocurrencies, including Bitcoin and Binance Coin from Binance.

Expert advisors play a big role in trading today. Large investment organizations, payment systems like PayPal and Mastercard, as well as banks, use automatic trading systems in their work, which independently analyze price fluctuations and make trading decisions based on built-in algorithms.

Final Thoughts

Prices in financial markets are constantly in a dynamic state. There are a lot of factors influencing the price movement.

In such conditions, a trader, like a surfer, must be able to catch a wave of price movement and “jump” in time having fixed a certain result.

To do this, it is important to regularly monitor currency quotes. Rates are one of the most convenient services for managing finances and tracking currency dynamics.

Daily, weekly, monthly and annual dynamics of USD, PLN, EUR, AUD are available for tracking.