Reading your Binance tax statement can be a daunting task, but it doesn’t have to be.

Understanding how to read your statement is crucial to accurately reporting your taxes and avoiding any legal issues, but how to read Binance tax statement?

In this article, we will guide you through the process of reading your Binance tax statement step by step.

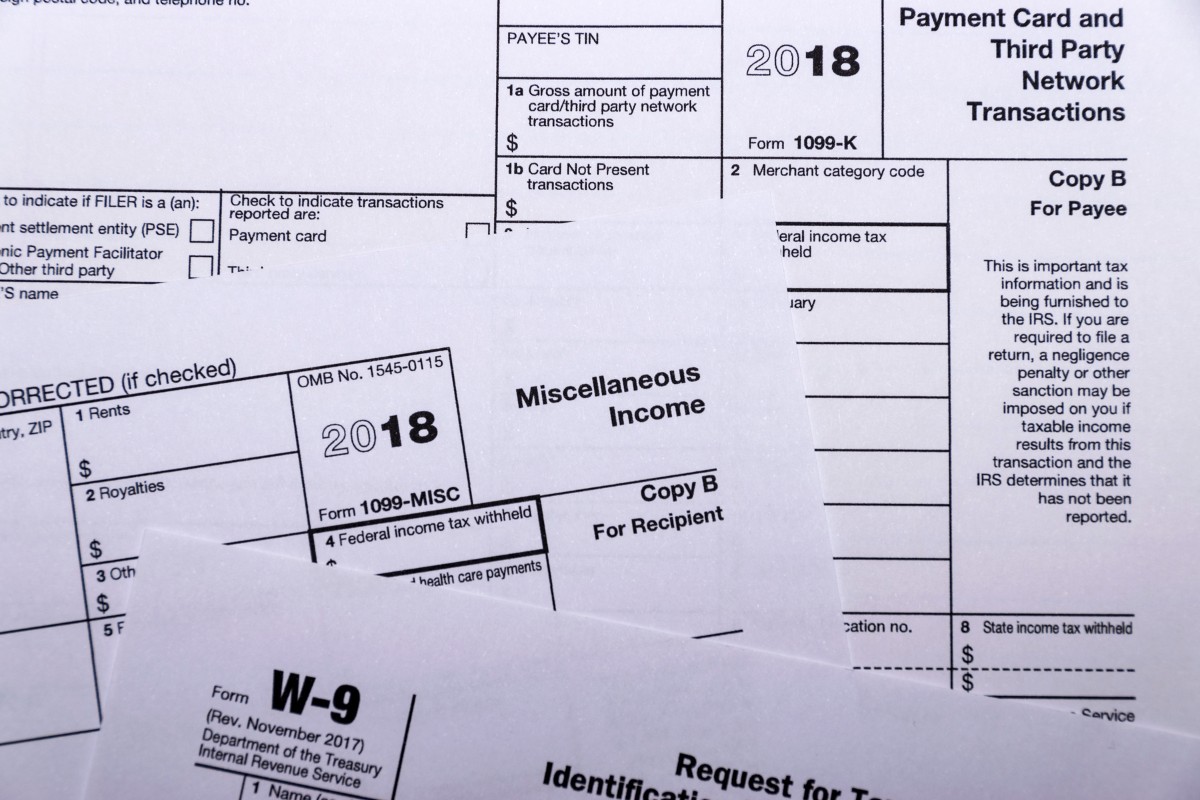

Firstly, it’s important to note that Binance provides two types of tax statements: the 1099-K and the 1099-B.

The 1099-K is used to report your gross revenue from cryptocurrency transactions, while the 1099-B is used to report any gains or losses from cryptocurrency trades.

It’s important to understand the difference between the two statements to ensure that you are accurately reporting your taxes.

Once you have downloaded your Binance tax statement, you will need to review it carefully.

The statement will include information such as your cryptocurrency transactions, gains or losses, and any fees that were incurred.

It’s important to review each section of the statement to ensure that all information is accurate.

If you notice any discrepancies, you should contact Binance support for assistance.

By following these steps, you can ensure that you are accurately reporting your taxes and avoiding any legal issues.

Post Contents

Understanding Binance Tax Statement

As a cryptocurrency trader, you have tax obligations that you need to fulfill.

Binance, one of the most popular crypto exchanges, provides a tax report that you can use to calculate your taxes.

In this section, we’ll take a closer look at the Binance tax statement and help you understand how to read it.

When you log in to your Binance account, go to the “Tax Reports” section to access your tax statement.

You’ll see an overview of your tax reports, a summary of your capital gains and income gains, and your transaction history below.

You can generate different types of reports, including FIFO, LIFO, and Adjusted Cost Basis.

The tax statement provides you with a comprehensive overview of your trading activity on Binance.

It lists all your trades, including the date, time, amount, and price.

You can use this information to calculate your capital gains or losses, which you’ll need to report on your tax return.

The tax statement also includes information about your income gains, such as staking rewards, airdrops, and mining rewards.

You’ll need to report this income on your tax return as well.

To make it easier for you to calculate your taxes, Binance also provides you with a summary of your capital gains and income gains.

This summary includes your total gains and losses, as well as your taxable income.

Setting Up Binance for Tax Reporting

If you’re a Binance user, you’re probably aware that you need to report your cryptocurrency transactions for tax purposes.

Fortunately, Binance makes it easy to generate tax reports by enabling API integration and auto-syncing with tax reporting software like Koinly.

Here’s how to set up Binance for tax reporting:

Enabling API Integration

To enable API integration, follow these steps:

- Log in to your Binance account on the Binance.us app.

- Tap the profile icon in the top-left corner of your app.

- Scroll down to the ‘Account’ section and select ‘API Management’.

- Tap ‘Create New API’.

- Enter a name for your API key and click ‘Create’.

- Enter your 2FA code to confirm the creation of your API key.

- Copy your API key and secret key to a secure location.

Auto Sync with Koinly

Once you’ve enabled API integration, you can auto-sync your Binance transactions with Koinly by following these steps:

- Sign up for a Koinly account.

- Navigate to the ‘Wallets’ page and click ‘Add Wallet’.

- Select ‘Binance’ as your exchange and enter your API key and secret key.

- Click ‘Import Transactions’ to sync your Binance transactions with Koinly.

With API integration and auto-syncing set up, you can easily generate tax reports for your Binance transactions.

Remember to download your complete Binance transaction history and select your tax jurisdiction and cost basis method when generating tax reports.

How to Read Binance Tax Statement

If you’re looking to read your Binance tax statement, you’ll need to follow a few simple steps.

First, navigate to the “Tax Reports” section of your Binance account.

Here, you’ll find an overview of your tax reports, including a summary of your capital gains and income gains, as well as your transaction history.

Once you’ve located your tax reports, you can generate a report by clicking the “Generate” button under the type of report you wish to create.

You can choose to generate a report for trades, income, or both.

The report will be downloaded as a CSV file, which you can then open in a spreadsheet program like Excel or Google Sheets.

When you open the CSV file, you’ll see a table with all of your cryptocurrency transactions for the year.

The table will include information such as the date of the transaction, the type of transaction (buy, sell, trade, staking, etc.), the asset involved, the amount of the transaction, and the cost basis.

It’s important to note that your Binance tax statement will only include transactions that occurred on the Binance platform.

If you have cryptocurrency transactions that occurred on other platforms or wallets, you’ll need to include those transactions separately on your tax forms.

When reading your Binance tax statement, be sure to pay attention to your gains and losses.

If you sold or traded cryptocurrency at a profit, you’ll need to report those gains on your tax forms.

If you sold or traded cryptocurrency at a loss, you may be able to deduct those losses from your income.

In addition to trades, your Binance tax statement may also include information about deposits, withdrawals, staking rewards, airdrops, and other investment activities.

Be sure to review all of the information in your tax statement carefully to ensure that you’re accurately reporting your cryptocurrency transactions on your tax forms.

Exporting Binance Tax Statement

Exporting your Binance tax statement is a straightforward process that can be done in just a few clicks.

Here’s how you can do it:

- Log in to your Binance account and tap the Profile Icon in the top-left corner of your app.

- Scroll down to the ‘Account’ section and select ‘Export Reports’.

- Tap ‘History & Tax Reports’.

- To customize your report, select the Asset, Transaction Type, and Date Range.

- Click on ‘Export’ to generate your report.

Your Binance tax statement will be downloaded in CSV file format, which can be easily opened in any spreadsheet program like Microsoft Excel or Google Sheets.

The CSV file contains detailed information about your transactions, including the date, asset, transaction type, and amount.

Once you have your CSV file, you can use it to generate a tax report for Binance using a third-party crypto tax app like Koinly.

These apps can take your Binance transaction report and use it to generate a tax report for Binance, which can help you calculate your tax liability accurately.

Binance Tax Statement and IRS

If you have been trading cryptocurrencies on Binance.US, you may need to report your transactions to the Internal Revenue Service (IRS) for tax purposes.

Binance.US provides a tax statement that you can use to calculate your capital gains or losses and report them on your income tax return.

When it comes to taxes, it is always a good idea to seek advice from a tax professional, especially if you are unsure about how to report your crypto transactions.

The IRS treats cryptocurrencies as property, which means that you need to report them on your Form 1040, U.S. Individual Income Tax Return, just like you would report the disposition of other capital assets.

Binance.US provides a detailed transaction history that you can use to calculate your capital gains or losses.

The transaction history includes information such as the date of the transaction, the type of transaction (buy, sell, transfer, etc.), the amount of cryptocurrency involved, and the price at which the transaction occurred.

If you received compensation in the form of cryptocurrency, such as through staking or airdrops, you may receive a 1099-MISC tax form from Binance.US.

This form reports the amount of cryptocurrency you received as income and must be reported on your income tax return.

If you transferred cryptocurrency from Binance.US to another exchange or wallet, you may also need to report this transaction on your income tax return.

It is important to keep accurate records of all your cryptocurrency transactions, including transfers, to avoid any potential issues during an audit.

Understanding Crypto Taxes

If you’re a U.S. resident who has invested in cryptocurrency, you need to understand your tax obligations.

The IRS considers cryptocurrency taxable, and you may need to report your gains and losses on your income tax return.

When it comes to cryptocurrency taxes, there are two types of taxable events: capital gains and income tax.

Capital gains occur when you sell or trade cryptocurrency for a profit, while income tax applies to transactions like receiving compensation in cryptocurrency or earning rewards in cryptocurrency.

To determine your tax obligations, you’ll need to keep track of your cryptocurrency transactions throughout the year.

Binance.US provides a transaction history that you can download to help you with this task.

It’s important to note that not all cryptocurrency transactions are taxable.

For example, if you bought cryptocurrency and held onto it for more than a year before selling it at a profit, you may qualify for long-term capital gains tax rates, which are typically lower than short-term capital gains tax rates.

To make sure you’re meeting your cryptocurrency tax obligations, it’s a good idea to consult with a tax professional who has experience with cryptocurrency tax reporting.

They can help you understand your tax obligations and ensure that you’re reporting your cryptocurrency transactions correctly.

Binance and Social Media

Binance is one of the most popular cryptocurrency exchanges in the world.

The company has a strong presence on social media platforms such as Twitter, Telegram, Facebook, and Instagram.

By following Binance on social media, you can stay up-to-date with the latest news, updates, and promotions.

Binance has an active Twitter account with over 2 million followers.

The company regularly posts updates about new listings, events, and promotions.

You can also follow Binance CEO Changpeng Zhao (CZ) on Twitter for his insights on the cryptocurrency industry.

Telegram

Binance has a Telegram channel where you can join the conversation with other traders and investors.

The channel is moderated by Binance staff and is a great place to ask questions and get support.

Binance has an official Facebook page with over 500,000 likes.

The page is updated regularly with news and updates about the company.

Binance has an Instagram account where you can see behind-the-scenes photos and videos of the company’s events and activities.

The account is a great way to get a glimpse into the world of cryptocurrency trading.

Legal and Risk Considerations

When it comes to dealing with taxes and cryptocurrency, it’s important to consider the legal and risk implications.

Here are some factors to keep in mind:

Disclaimer

Before diving into reading your Binance tax statement, it’s important to note that this article is for informational purposes only and should not be considered as legal or tax advice.

Every individual’s tax situation is unique and you should always consult with a qualified tax professional before making any investment decisions.

Legal Disclaimer

Cryptocurrency is a relatively new and rapidly evolving asset class.

As such, the legal landscape surrounding it is still developing.

Regulations and laws can vary by jurisdiction, so it’s important to understand the legal implications of your actions when dealing with cryptocurrency.

Investment Decision

Investing in cryptocurrency carries a high degree of risk and should be approached with caution.

It’s important to do your own research and understand the risks before investing any money.

Binance’s tax statement can provide valuable insights into your trading activity, but it should not be the sole factor in making investment decisions.

Risk Warning

The cryptocurrency market is highly volatile and subject to extreme price fluctuations.

This means that the value of your investments can change rapidly and unpredictably.

It’s important to be aware of this risk and to only invest money that you can afford to lose.

Market Risk

The cryptocurrency market is largely unregulated and can be subject to manipulation, fraud, and other risks.

It’s important to be aware of these risks and to take steps to protect yourself, such as using reputable exchanges and wallets.

Price Fluctuations

The value of cryptocurrencies can fluctuate rapidly and dramatically.

This means that the value of your investments can change significantly in a short period of time.

It’s important to be aware of this risk and to be prepared for potential losses.

Terms of Use

When using Binance’s tax reporting tool, it’s important to be aware of the terms of use.

Make sure to read and understand the terms before using the tool to avoid any potential legal issues.

Risk Factors

In addition to the risks outlined above, there are other risk factors to consider when dealing with cryptocurrency.

These can include technological risks, regulatory risks, and operational risks.

It’s important to be aware of these risks and to take steps to mitigate them.

Key Takeaways

When reading your Binance tax statement, there are a few key takeaways that you should keep in mind to ensure that you understand your tax obligations and can accurately file your taxes.

Here are some of the most important things to keep in mind:

- Binance does not provide a specific tax report. While Binance does not provide a specific tax report, it is partnered with a variety of excellent crypto tax apps (like Koinly) that can take your Binance transaction report and use it to generate a tax report for Binance. These apps can help you to calculate your gains and losses, and ensure that you are accurately reporting your cryptocurrency transactions on your tax return.

- Cryptocurrency is considered property by the IRS. The IRS has deemed cryptocurrency to be “property,” which means that tax rules that apply to property transactions also apply to cryptocurrencies. This means that you may have tax obligations if you are a U.S. resident who conducts cryptocurrency transactions.

- Not all transactions are taxable. Not all cryptocurrency transactions are taxable. For example, if you transfer cryptocurrency from one wallet to another, this is not a taxable event. However, if you sell cryptocurrency for a profit, this is considered a taxable event and you will need to report your gains on your tax return.

- Keep accurate records of your transactions. It is important to keep accurate records of all of your cryptocurrency transactions, including the date, time, and amount of each transaction. This will help you to calculate your gains and losses and ensure that you are accurately reporting your transactions on your tax return.

- Consult a tax professional if you are unsure. If you are unsure about your tax obligations or how to report your cryptocurrency transactions on your tax return, it is always a good idea to consult a tax professional. They can help you to understand your tax obligations and ensure that you are accurately reporting your cryptocurrency transactions on your tax return.