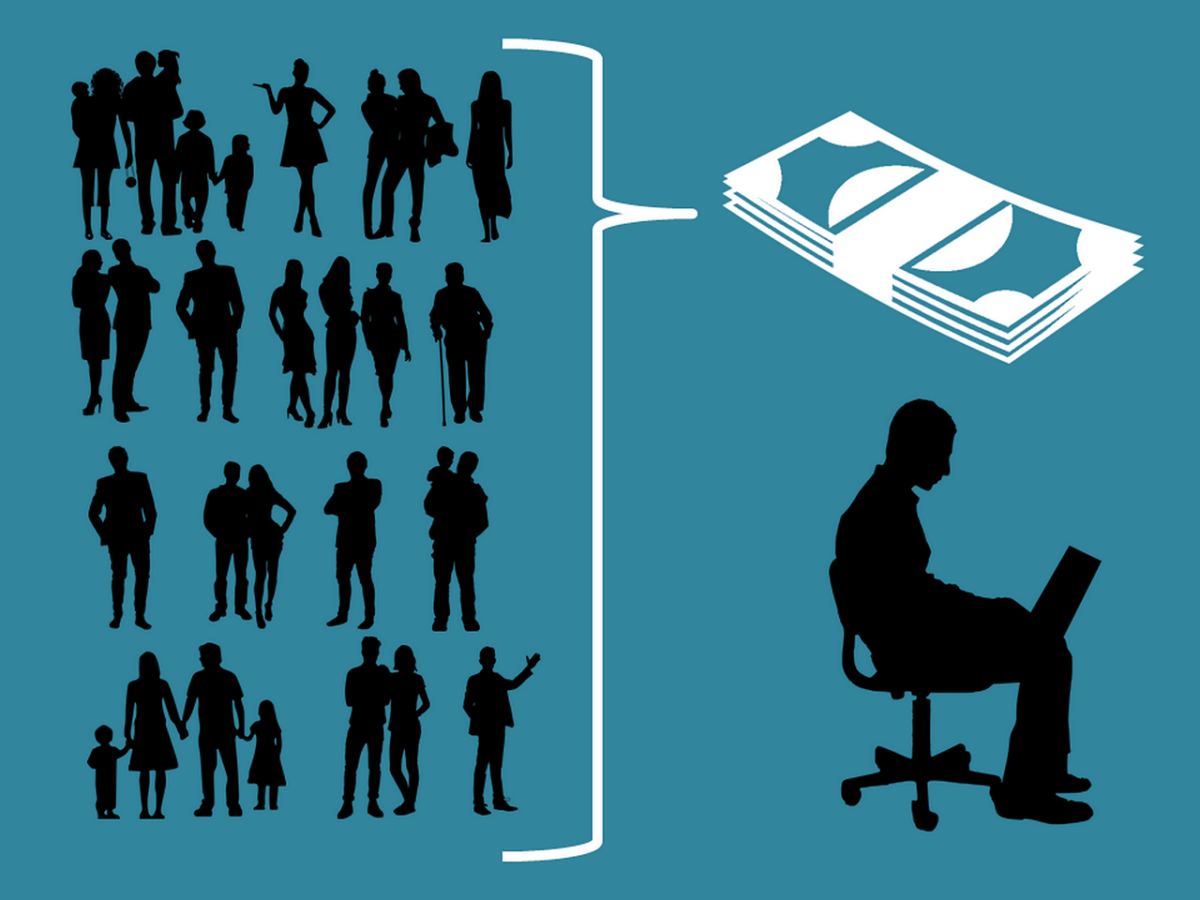

Surely, you may have heard of successful crowdfunding platforms such as Kickstarter, Patreon, and Indiegogo, and you are even more likely to wonder what it is and how it works.

In short, this is a method by which inventors and startups from around the world (with every little help) raise funds for the development of their projects via the Internet.

Applicant registration is done on the crowding platform, and sponsors donate their money.

The last are also known as backers. They are usually doing it as a charity or in exchange for early access to the product.

Here’s something you may not have heard of yet – crowdfunding platforms can earn up to 10% of the crowdfunding amount from each successful company.

If the applicant’s financial goal is not met, the money already collected will be returned to the donors, or the platforms will dispose of the funds at their discretion.

As a rule, they invest the funds in other projects, which they report to their donors. This information raises the question of how to build your crowdfunding platform.

Our expert from LenderKit answers. Spoiler – when will it be available to obtain an ECSPR license for crowdfunding – read about it at the end. This is interesting for startups.

Post Contents

Briefly About How You Can Build A Crowdfunding Platform — 3 Steps

A successful project starts with a clearly defined target audience. Initially, you need to analyze potential demand – which projects are most likely to receive funding.

Charity, video game development, or the search for an extraterrestrial civilization are some things it could be for.

For example, Indiegogo started as a platform for funding projects in the film industry, while Kickstarter focused on small P2P campaigns.

This wors like any registered user can collect money, for example, for a hiking trip around the world.

The fundamental difference lies in the scale of projects for which money will be donated on your crowdfunding platform.

This affects the list of monetization and identity mechanisms that should be integrated into your service: for business projects, you cannot do without KYC.

Another promising funding niche is blockchain startups – for them, you need smart contracts (to raise funds and pay out tokens) to succeed.

1. Choice Of The Crowdfunding Model

We are talking about choosing the business model of your platform – this is about the conditions under which investors will give their money to applicants. There are five such conditions:

A.) As A Donation

This is suitable for charity projects. This is how Crowdrise and MightyCause work.

B.) In Return For A Reward

It can be a branded mug or t-shirt. But most often, sponsors are rewarded in the form of a return PR service or early access to the product. Kickstarter and Fundable work according to this model.

C.) In Exchange For A Share In The Business

It is suitable for commercial projects where investors are looking for promising start-ups. This is how IndieGoGo and Lending Club work.

D.) The P2P Lending Model

It works when investors invest money in exchange for dividends, proportionally to the size of the investment. This model can be used as an alternative to bank lending.

E.) In Exchange For Tokens

This is when, in exchange for financing, investors receive “digital” shares – project tokens. This relatively new business model is suitable for funding blockchain startups.

You can keep up to 10% of each amount collected. Your platform will also earn a percentage of every withdrawal transaction.

You will spend money on the technical and administrative support of the platform, as well as on attracting new applicants and backers.

In addition to the percentage fee – 5% of the transaction – you will be paid for listing, subscription, advertising, and additional services (for example, for consulting or a high position on the table of applicants).

When the cost of attracting one user is less than the cost of bringing you money, your crowdfunding campaign will become commercially justified. It will take you 2–3 years to reach the payback.

2. Platform Features

An incomplete list of features for your future platform include registration, project listing, account management, and tools for working with payment gateways and marketing tasks.

If you are targeting Eastern Europe, the Middle East, and Asia, you should also connect local payment gateways.

All functions should work quickly, and access to them was in one, maximum, in three clicks.

To speed up user navigation on the platform, consider informative onboarding. Your main task is to provide security and online user support.

For the first one, integrate KYC tools. The support service should complete the solution of disputes, typical system problems, and user assistance.

3. Choice Of Technologies For Platform Development

The project’s practical implementation begins with the choice of platforms on which it will be launched.

You have a written by programmers site to choose from – this one is written from scratch by a developer, and then tested and deployed.

This advantage is maximum control and 100% uniqueness. The latter is important for search engines. Disadvantages – the project is implemented for a long time, and it is expensive.

Alternatively, you can refer to design solutions. With their help from ready-made templates, your crowdfunding platform will be ready to launch in 1 month.

Advantages – such a solution is cheaper, and it can be immediately launched on different operating systems.

Disadvantages – limited choice of interface personalization, and difficult integration of new functions.

In A Conclusion — This Is About The ECSPR License

Introductory information. Since crowdfunding is an economic activity, it falls under the financial statements of both the project resident country and the territory from whose residents’ funds are raised.

In order to obtain an ECSPR license, you must study each participating country separately, and in order not to fall under sanctions, you must follow the constantly changing legislation.

The European Crowdfunding Provider Regulation (ECSPR) was introduced on 10 November 2021.

Several platforms received an ECSPR license a year after the transition to new standards, but the regulation is still in the process of being coordinated and harmonize with the legislative framework of the EU countries.

Until the new ECSPR rules come into effect, our partner LenderKit has already begun technical preparations for updates, under which new features are being developed.

It is an investment software developer for crowdfunding platforms that is working on solutions that help automate transactions and attract more investors and fundraisers.

This means that there will be more private equity deals.