The financial world was shaken last week when the FED announced that it had stepped in and taken control of Silicon Valley Bank.

While the FED has been careful not to use the term “bailout”, the fact is that the treasury has set aside $25 billion in guarantees.

While Silicon Valley Bank’s sudden demise came as a shock to many, some critics point out that the tech bank was in fact built on shaky foundations and had taken some serious financial risks.

Other commentators are inevitably asking whether Silicon Valley bank may prove to be this decade’s Lehman Brothers and whether a widespread banking crisis may now be inevitable.

In this post we are going to take a closer look at exactly what happened to Silicon Valley Bank and what it means for banking.

Post Contents

Who Was Silicon Valley Bank?

Founded in 1983 by two former Bank of America employees, Silicon Valley Bank was founded with the intention of creating a bank that focused on the needs of start-ups – a market that was previously little served, and even less understood by the banking sector at the time.

Silicon Valley was well situated to benefit from the dot.com boom of the 1990’s which provided an influx of clients for the bank – by 1995 the bank listed both Cisco and Bay Services among its clients base.

When the dot.com bubble reached its apex, Silicon Valley’s stock soared only to promptly fall by 50% when the bubble burst in 2001.

SBV was also impacted by the financial crisis of 2008 and received $285 million in federal support.

At the time of its demise last week, Silicon Valley’s client base was primarily made up of customers (both businesses and individuals) based in tech, life science, venture capital and private equity. The bank had operations in the US but also in India, China, Israel and the UK.

Was Silicon Valley Bank Reputable?

Having made it into its 4th decade and having survived two previous sector crises already (one in tech and one in banking), Silicon Valley was widely regarded as a strong and respectable bank.

In fact, as late as February 2023 Forbes named SVB as the “20th best bank in America”. SVB was also favoured by California’s more illustrious residents and notably, 14% of its mortgagors were high net worth individuals.

That said, it must be borne in mind that Silicon Valley nevertheless remained something of a niche financial services provider – it was not a commonly regarded household name and comparing its collapse to the 2008 demise of Lehman Brothers is something of a serious stretch.

What Silicon Valley Bank Offered

As we already said, SVB was founded as a bank primarily servicing startups, very few of which were initially profitable.

Additionally. Silicon Valley Bank also built up and maintained very strong relationships with the venture capital (44% of venture capital forms have funding from SBV) and the private equity communities.

Not only did Silicon Valley Bank have close ties with venture capital, in many ways it behaved like a venture capital firm itself in its operations and lending models.

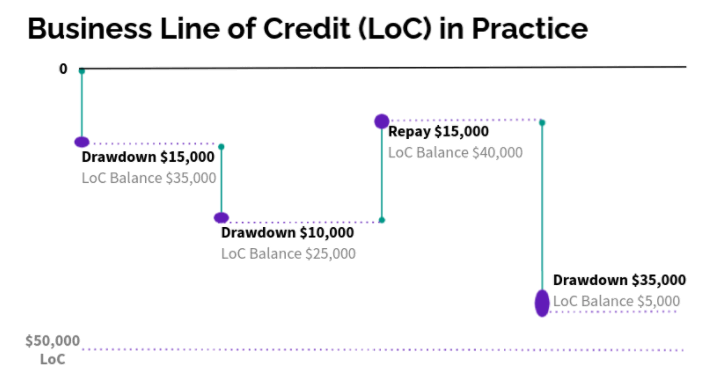

Responding to the real world needs of startups, Silicon Valley Bank offered start-ups rolling lines of credit which allowed them to draw down and repay funds as and when they needed it.

The below graphic from by smallbusinessloansaustralia.com. It is an example of how a rolling line of credit works.

It is very rare for banks and lenders to offer rolling lines of credit so this, along with their expertise and sheer prestige in and around the San Francisco Bay area made it unique in the banking sector.

Background Of The Collapse Of Silicon Valley Bank

Following the financial crisis of 2008, many of the world’s governments and central banks passed extensive legislation and imposed new regulatory burdens upon all banks with $50 billion worth of assets.

Of course, even at the time there was political discord regarding the changes with some critics arguing that they were too severe, would restrict the banks’ ability to operate and would therefore undermine economic growth.

Simultaneously opposing voices expressed concerns that the new rules did not go far enough to protect the economy from further crises.

In 20018 the Trump administration began to scale back some of these protective measures and crucially, removed the $50 billion threshold, reducing the amount of capital and liquidity that banks lille SBV had to demonstrate in order to pass the FED’s stress tests.

What Did SBV Do Wrong And What Caused Its Collapse?

Since 2008, global interest rates have remained historically low. However in order to counter post-pandemic inflation, the central banks of the world including the FED have begun raising interest rates quite sharply.

In the US, the interest rate increased from 0.5% to 4.5% in under a year and the impacts of this have been hard on mortgage borrowers.

The simple fact is that Silicon Valley Bank was caught completely unprepared for this and paid the price.

The bank had invested heavily in long term mortgage securities and government bonds essentially betting on interest rates remaining low.

When interest rates rose, the value of Silicon Valley Banks’ assets fell while at the same time they were having to sell more and more of these assets in order to keep up with the soaring, post-pandemic liquidity demands of their start-up clients.

Aftermath Of Silicon Valley Banks Collapse

Silicon Valley Bank was not a household name like Lehman Brothers was. Furthermore as they operated in something of a niche the ramifications of the failure of SBV are for the most part, quite limited.

The tech and start-up sectors will certainly feel some pain though – even though existing business customers’ deposits and credit facilities are guaranteed, going forward it will now prove much harder for new startups to access funding at least until a competitor bank decides to step in and pick up the mantle previously held by SBV.

In short, the economy of the Silicon Valley and wider Bay area may well take a hit, and America’s reputation for innovation may stall slightly.

That said, the failure of a bank always sends shockwaves across the financial markets and bank stocks worldwide have fallen by a total of $185 billion.

While there has not yet been a full “run” on banks like we saw in 2008, customers spooked by the collapse of SBV have begun withdrawing their money from some US banks.

This led to the failure of a second bank, Signature Bank who failed earlier this week after customers withdrew $10 billion.

Furthermore, news broke today that First Republic has secured a $30 billion rescue package from other banks in order to avoid dissolution.

Commentators are being careful not to speak about a domino effect and there is hope that the failures witnessed of late will prove to be anomalous and ultimately be contained.

Is A Re-run Of 2008 Likely?

Silicon Valley Bank and Signature Bank represent the second and third largest failures in US banking history.

Three banks have fallen within the space of 10 days and then the Swiss Bank Credit Suisse has also made headlines after seeking a $50 billion support package from the Swiss Government.

Inevitably, some commentators are now speculating as to whether a repeat of the 2008 financial crisis is likely.

However, there are some very important differences between the current problems in the banking sector and the 2008 crisis, and the FED’s actions to date are relatively limited compared with those of 15 years ago.

Importantly, the two failed banks themselves have not been rescued, and taxpayer money was not handed to the banks.

What About Inflation?

Perhaps of more concern though is the impact that the extra liquidity in the markets will have on inflation.

Inflation is already running at its highest in decades and the extra money now flowing into the US economy can only exacerbate that.

Problematically, following the collapse of SBV, central banks around the world may now be reluctant to raise interest rates any further which could lead to hyperinflation the likes of which has not been seen in the West since the 1970’s or even runway inflation the likes of which plagues the Weimar Republic.

Should I Stick To Bigger Banks?

The failure of Silicon Valley Bank has caused some account holders and investors to question whether their money is truly safe in smaller banks or whether they are in fact better off moving their accounts, assets and wealth over to a bigger, more established bank.

This is almost certainly what led to the problems faced by both Signature Bank and First Republic this week.

On balance though, customers of smaller banks are probably better off sticking with them.

Firstly, it is absolutely important to bear in mind that in 2008, even Lehman Brothers failed and then the recent hiccups expressed by Credit Suisse only serve as a further reminder that bigger does not mean safer. Indeed, while SVB was a niche bank, it was not exactly “small”.

Furthermore, in the case of a catastrophic banking failure, most savers would be covered by the FDIC’s Deposit Insurance fund which guarantees up to $250,000 per account.

Finally, as we argued previously, the majority consensus so far seems to be that the problems seen in the banking industry recently are isolated cases.

What Smaller Banks Offer

In truth, “smaller” banks like the late SBV often prove a much better option than bigger banks for many customers. Smaller banks tend to provide a much better and often personalized service.

Whereas a customer can spend hours on the phone trying to resolve a query with numerous big bank departments, smaller banks tend to be able to resolve issues fast and at the first point of contact.

Let’s also remember that the reason Silicon Valley Bank became so ubiquitous among its niche is because they offered a unique product that none of the larger banks do.

Final Thoughts

There is no denying that we are living through economically difficult times. Wealth and income disparity has been increasing in the west for decades and the toxic combination of post-pandemic inflation coupled with geo-political conflicts is only making the situation worse. As such, the recent wobbles witnessed in the banking sector could barely have come at a worse time.

At this time, a full scale collapse in the banking sector like we saw in 2008 seems unlikely (although of course, it seems unlikely to many back in 2008) but what is of a more immediate concern is the sheer amount of liquidity now being pumped into the markets which can only cause inflation to rise further.

If any readers out there are wondering whether small banks have a future, then the prognosis seems fine. Ultimately, for the most part, small and medium banks are as well positioned to weather these tumultuous times as anybody else.