Digital transformation is transforming the manner we deal with financial services by offering faster, more convenient, and accessible financial processes.

An important aspect of digital transformation was the introduction of payment platforms.

They enabled individuals and businesses to securely manage their payments online with advanced technologies like mobile apps, digital wallets, and online payment gateways.

This article presents 10 best FinTech companies providing payment services to monitor in 2023.

Join us on this journey as we explore the exciting world of FinTech payment platforms that are poised to reshape the way we transact in the coming year.

Post Contents

Key Selection Factors: Criteria For Evaluating Top Payment Platforms In 2023

In order to identify the top 10 digital payments platforms, we considered several key criteria:

Innovation And Technological Advancements

One of the primary considerations was their ability to embrace and leverage emerging technologies in payment app development.

These platforms incorporate cutting-edge technologies and offer unique functionalities that enhance the user experience and provide greater convenience and security in digital transactions.

User Experience And Interface

The platforms chosen for this list demonstrated exceptional user experience, featuring intuitive interfaces, seamless navigation, and smooth transaction processes.

A user-friendly design and a focus on enhancing customer satisfaction were taken into account when evaluating the platforms.

Security And Privacy Features

The selected platforms excelled in implementing robust security measures to safeguard user information, protect against fraud, and ensure secure transactions.

Encryption protocols, multi-factor authentication, and compliance with industry standards were among the factors considered to ensure the platforms’ commitment to user security.

Market Presence And Growth Potential

The selected platforms exhibited a strong market presence, with a notable user base and a wide range of supported industries and sectors.

Furthermore, the platforms displayed promising growth potential, which was assessed through factors such as partnerships, funding, and projected expansion plans.

These criteria collectively provided a comprehensive framework for evaluating the payment platforms and identifying the top 10 platforms to watch in 2023.

Introducing Top 10 Payment Platforms In 2023

In this section, we will explore the top 10 FinTech payments companies in 2023, each offering unique features and advantages:

I. PayPal

PayPal has established itself as a frontrunner in the industry. With its extensive reach and versatile offerings, PayPal continues to shape the digital payment landscape.

Key Features Of PayPal

- Online payments: Users can make seamless online payments for goods and services.

- Fund transfers: PayPal facilitates quick and convenient transfers between individuals and businesses.

- Peer-to-peer transactions: Users can send money to friends, family, or colleagues with ease.

- Payment processing: PayPal provides payment processing services for businesses, enabling them to accept payments on various online platforms.

Competitive Advantages

- Brand recognition: PayPal benefits from strong brand recognition and trust among users.

- Global reach: With a presence in over 200 countries and supporting multiple currencies, PayPal offers a truly global payment solution.

- Seamless integration: PayPal’s integration capabilities allow it to seamlessly integrate with e-commerce platforms, providing businesses with a smooth payment experience.

- Buyer and seller protection: PayPal offers strong protection measures, including conflict resolution solutions and anti-fraud measures, enhancing user confidence.

II. Paytm Business

Paytm Business has emerged as a leading payment platform, specifically tailored for businesses. With its pack of features and services, Paytm Business facilitates smooth and efficient payment processes.

Key Features of Paytm Business

- Digital payments: Businesses can accept digital payments from customers, enabling seamless transactions.

- Invoicing and billing: Paytm Business provides invoicing and billing solutions, streamlining financial operations.

- Inventory management: The platform offers tools to manage inventory, ensuring efficient stock tracking and replenishment.

- Analytics and reporting: Paytm Business provides detailed analytics and reporting features for businesses to gain insights into their financial performance.

Competitive Advantages

- Wide acceptance: Paytm Business has gained widespread acceptance among businesses, both large and small, across various sectors.

- QR code payments: The platform’s QR code-based payment system simplifies transactions and enhances user convenience.

- Integration capabilities: Paytm Business seamlessly integrates with various e-commerce platforms, enabling businesses to accept payments effortlessly.

- Strong user base: With millions of users already utilizing Paytm for their transactions, Paytm Business enjoys a significant user base and brand recognition.

III. Apple Pay

Apple Pay has established itself as a dominant force in the payment industry, providing users with a seamless and highly secure mobile payment experience.

Key Features of Apple Pay

- Contactless payments: Users can conveniently and securely make swift payments utilizing their Apple devices, eliminating the necessity for physical cards.

- Biometric authentication: Apple Pay utilizes biometric authentication methods like Touch ID and Face ID, ensuring secure and convenient transactions.

- Integration with apps and websites: The platform seamlessly integrates with various apps and websites, enabling users to make purchases with a single touch.

- Peer-to-peer payments: Through iMessage or Siri, Apple Pay enables users to effortlessly transfer funds to and receive money from their loved ones.

Competitive Advantages

- Seamless integration: Apple Pay’s deep integration with Apple’s devices and operating systems provides a seamless and intuitive payment experience for Apple users.

- Strong security measures: The platform prioritizes user security by utilizing tokenization, encryption, and biometric authentication, offering enhanced protection against fraud.

- Wide merchant acceptance: Apple Pay has gained widespread acceptance among merchants, making it available at a growing number of retail stores, restaurants, and online platforms.

- Loyalty and rewards integration: Apple Pay integrates with various loyalty and rewards programs, allowing users to easily earn and redeem points or discounts.

IV. Stripe

Stripe empowers businesses to streamline their payment processes via their functionality and service suite.

Key Features of Stripe

- Payment infrastructure: Stripe provides a robust payment infrastructure that enables businesses to accept payments from customers seamlessly.

- Customizable payment flows: The platform offers flexible payment flows, allowing businesses to tailor the payment experience to their specific requirements.

- Multi-party transactions: Stripe facilitates complex payment flows involving multiple parties, such as platforms, sellers, and customers.

- Integrated services: Stripe integrates with various services like fraud detection, subscriptions, and invoicing, providing businesses with a comprehensive solution.

Competitive Advantages

- Scalability and flexibility: The platform’s infrastructure and customizable payment flows make it suitable for businesses of all sizes and industries.

- Developer-friendly: Stripe offers robust APIs and developer tools, making it highly attractive to businesses with technical expertise.

- Global reach: With support for multiple currencies and international transactions, Stripe serves businesses operating in a global marketplace.

- Partner ecosystem: Stripe has built a strong partner ecosystem, collaborating with other platforms and services to offer businesses a seamless end-to-end solution.

V. Razorpay

With its user-friendly interface and robust features, Razorpay streamlines the payment process for businesses of all sizes.

Key Features of Razorpay

- Payment gateway: Razorpay provides a secure and reliable payment gateway that enables businesses to accept online payments.

- Subscription billing: The platform offers subscription billing capabilities, allowing businesses to manage recurring payments seamlessly.

- In-app payments: Razorpay enables businesses to integrate in-app payments, providing a frictionless payment experience for mobile app users.

- Smart routing: The platform intelligently routes transactions through multiple payment gateways to optimize success rates.

Competitive Advantages

- Developer-friendly: Razorpay provides a developer-friendly environment with easy-to-use APIs and extensive documentation, making integration seamless for businesses.

- Customizable checkout experience: The platform allows businesses to customize the payment checkout page, ensuring a consistent brand experience for customers.

- Strong security measures: Razorpay employs stringent security measures to safeguard valuable customer data and mitigate the risk of fraudulent transactions, ensuring the protection of sensitive information.

- Value-added services: Razorpay offers additional services, such as automated invoice generation, payment links, and advanced analytics, enhancing the overall payment experience for businesses.

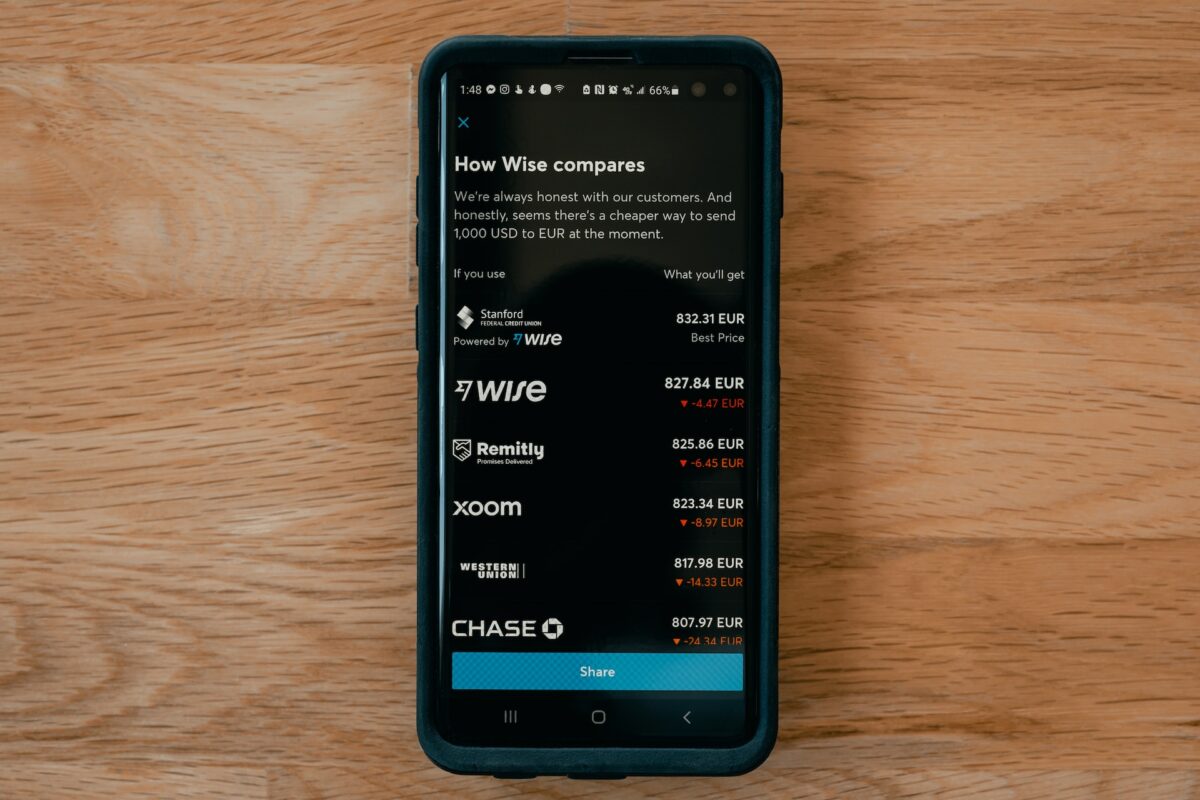

VI. Wise

With its innovative approach and customer-centric features, Wise has redefined the way individuals and businesses send and receive money across borders.

Key Features Of Wise

- Borderless accounts: Wise provides users with borderless multi-currency accounts, allowing them to hold and manage funds in different currencies.

- Low-cost transfers: The platform offers competitive exchange rates and transparent fees, resulting in significant cost savings compared to traditional banking channels.

- Fast transactions: Wise ensures swift transfer times, enabling users to send and receive money quickly, often within a matter of hours.

- Transparency: Wise provides real-time exchange rate information and fee breakdowns, ensuring transparency in international transactions.

Competitive Advantages

- Transparent pricing: Wise’s transparent fee structure and mid-market exchange rates eliminate hidden charges, providing users with greater cost predictability.

- Wide global coverage: Wise supports transfers to over 80 countries and multiple currencies, making it a comprehensive solution for international payments.

- Local banking infrastructure: With local banking partnerships in various countries, Wise offers users the advantage of using local bank accounts for receiving funds, reducing transaction costs and time.

- Peer-to-peer transfers: Wise allows users to send money directly to other Wise users, bypassing traditional banking intermediaries.

VII. GoCardless

GoCardless specializes in recurring payments and is designed to simplify the collection of recurring payments.

Key Features of GoCardless

- Automated Direct Debit: GoCardless enables businesses to set up and automate Direct Debit payments, ensuring timely and hassle-free collection of recurring payments.

- Payment scheduling: The platform allows businesses to schedule payments at regular intervals, providing predictability and convenience for both businesses and customers.

- Subscription management: GoCardless offers comprehensive subscription management tools, allowing businesses to handle cancellations, upgrades, and downgrades efficiently.

- Payment notifications: GoCardless provides real-time payment notifications, keeping businesses informed about successful and failed transactions.

Competitive Advantages

- Seamless integration: GoCardless effortlessly merges with diverse accounting, billing, and CRM platforms, simplifying the process for businesses to integrate the platform into their current workflows.

- Global reach: With its extensive network of bank partners, GoCardless supports payments in multiple countries, making it suitable for businesses with international operations.

- Cost-effective pricing: GoCardless offers competitive pricing plans, allowing businesses to manage recurring payments without incurring high transaction fees.

- Advanced analytics: The platform provides businesses with valuable insights and reporting on payment performance, enabling them to optimize their recurring payment processes.

VIII. Payoneer

With its robust features and global reach, Payoneer simplifies cross-border transactions.

Key Features of Payoneer

- Global payment processing: Payoneer empowers businesses and professionals to effortlessly send and receive payments across various currencies, facilitating seamless international trade and transactions.

- Multi-currency accounts: The platform offers users the convenience of multi-currency accounts, granting them the ability to securely hold and oversee funds across various currencies.

- Mass payout solutions: Payoneer offers efficient mass payout capabilities, enabling businesses to disburse payments to multiple recipients at once.

- Payment tracking and reporting: Payoneer provides detailed transaction tracking and reporting, giving users insights into their payment activities.

Competitive Advantages

- Global presence: With its extensive network and partnerships, Payoneer has established a strong global presence, enabling businesses and professionals to transact with ease in various countries.

- Secure and compliant: Payoneer adheres to strict security protocols and compliance standards, ensuring the safety of transactions and sensitive financial information.

- Integration with marketplaces: Payoneer integrates seamlessly with leading e-commerce marketplaces and freelance platforms, facilitating efficient payments for online sellers and freelancers.

- Value-added services: Payoneer offers additional services like tax solutions, working capital financing, and virtual bank accounts, enhancing its value proposition for users.

IX. Helcim

Helcim simplifies payment processing for businesses of all sizes and offers a user-friendly interface and rich range of features.

Key Features of Helcim

- Payment processing: Helcim offers a range of payment processing options, including credit card, debit card, and eCheck payments.

- Online and in-person payments: The platform supports both online and in-person transactions, allowing businesses to accept payments through various channels.

- Point-of-sale (POS) systems: Helcim provides businesses with POS systems that integrate with its payment processing capabilities, offering a streamlined checkout experience.

- Reporting and analytics: Helcim offers detailed reporting and analytics tools, providing businesses with insights into their payment performance and customer behavior.

Competitive Advantages

- Transparent pricing: Helcim provides businesses with transparent and competitive pricing structures, guaranteeing a comprehensive grasp of their payment processing expenses while maintaining a strong focus on cost-effectiveness.

- Excellent customer support: Helcim is known for its exceptional customer support, providing businesses with responsive assistance and guidance.

- Advanced security features: The platform places a high emphasis on security, incorporating strong encryption and advanced fraud prevention measures to safeguard sensitive payment data effectively.

- Customizable solutions: Helcim understands the unique needs of small businesses and offers customizable payment solutions to meet their specific requirements.

X. Square

With its range of features and user-friendly tools, Square simplifies payment processing for businesses of all sizes.

Key Features of Square

- POS systems: Square provides businesses with intuitive and versatile point-of-sale systems that enable seamless in-person payments.

- Online payment processing: The platform offers secure and efficient online payment processing capabilities, allowing businesses to accept payments through websites and mobile apps.

- Mobile payments: Square’s mobile payment solutions empower businesses to conveniently process payments while on the move.

- Inventory management: Square includes inventory management features, enabling businesses to track and manage their products and stock levels.

Competitive Advantages

- All-in-one solution: Square provides businesses with an all-in-one payment solution that encompasses hardware, software, and payment processing, simplifying the setup and management process.

- Easy-to-use interface: Square’s user-friendly interface and intuitive tools make it accessible to businesses without extensive technical expertise.

- Robust ecosystem: Square offers additional services such as financing, marketing, and loyalty programs, enhancing its value proposition for businesses.

- Integration capabilities: Square seamlessly integrates with popular third-party platforms, enabling businesses to streamline their operations and leverage existing systems.

Conclusion

The FinTech payment landscape is evolving rapidly, and staying updated with emerging platforms is crucial for businesses and individuals alike.

The top 10 FinTech payment platforms to watch in 2023 offer innovative solutions, seamless user experiences, enhanced security, and substantial growth potential.

Whether it’s the global reach of PayPal, the convenience of Apple Pay, or the versatility of Square, these platforms are reshaping the way we transact and manage payments.

With their competitive advantages and targeted industry focus, these platforms are poised to make a significant impact in the FinTech industry.