As a personal finance enthusiast, I’ve been exploring the best budgeting tools in 2024, and two standout options are Quicken and Mint.

These popular financial management platforms have been around for quite some time, each offering unique features tailored to different financial needs.

In this article, we’ll dive into a detailed comparison of Quicken vs Mint to help you determine which platform is better suited for your money management goals in 2024.

Post Contents

Quicken vs Mint: Overview

History

As a financial software enthusiast, I have always been interested in how Quicken and Mint, two popular personal finance management tools, have evolved over time.

Quicken has a long history to its credit, as it was developed by Intuit back in 1983 and later sold to H.I.G. Capital in 2016.

This desktop-based system has seen continuous improvements and expansion of features over the years.

Mint, a newer player in the market, was launched in 2006 and eventually acquired by Intuit in 2009.

Mint’s focus has always been on providing a free, cloud-based budgeting app accessible from anywhere.

Thanks to its integration with modern devices, Mint has gained massive popularity among users looking for a convenient way to manage their finances.

Platform Availability

Being a tech-oriented person, I always appreciate how important it is for financial tools to be available across multiple platforms.

Quicken, known for its desktop-based software, also offers a mobile app for iOS and Android devices, allowing users to sync their data and access their budget from their phone and iPad with ease.

With several pricing plans ranging from $41.88 to $119.88 per year, users can choose the plan that suits their needs best.

Mint, on the other hand, was designed as a cloud-based platform, making it available on both desktop and mobile devices.

This means that I can access my Mint account from any device with an internet connection, be it my phone, iPad, or computer.

The iOS and Android mobile apps enable me to track my finances on-the-go, making it a perfect fit for a busy lifestyle. What’s more, Mint is completely free to use, which is a major draw for many users.

Here’s a quick comparison of the two when it comes to platform availability:

| Platform | Quicken | Mint |

|---|---|---|

| Desktop | Yes | Yes |

| iOS (iPhone & iPad) | Yes | Yes |

| Android | Yes | Yes |

| Price | $41.88 to $119.88 per year | Free |

Features Comparison

Budgeting and Expenses

When it comes to budgeting, Mint and Quicken offer different approaches.

Mint allows me to create customized budgets based on my financial goals and provides me with helpful alerts when I’m nearing or going over my budget limits.

Quicken, on the other hand, offers a choice between a 1-month or 12-month budget, which automatically includes my recurring income and expenses, making it a bit more hands-off.

Accounts and Transactions

Both Mint and Quicken allow me to connect and sync with my financial accounts, streamlining my transactions for easier financial management.

Both tools can accurately categorize my receipts, payments, and transactions, helping me see where my money is going.

Mint offers bill tracking and reminds me when my payments are due, while Quicken offers a more comprehensive bill management feature, allowing me to schedule and pay bills directly through the software.

Investments and Net Worth

Quicken shines when it comes to investment tracking and net worth calculation.

Its Premier version offers advanced investment tracking tools, including portfolio analysis, investment performance, and market comparisons.

Mint, on the other hand, provides a more basic investment tracking feature but still allows me to keep an eye on my overall net worth by tracking all my bank, investment, and retirement accounts.

Goals and Savings

Mint and Quicken both offer goal-setting and savings tracking features.

Mint includes debt payoff planning within its goal-setting feature, allowing me to create a plan to “crush credit card debt.”

Quicken also offers a Debt Reduction Planner in its Deluxe plan, helping me stay on track with my debt repayments.

Reports and Analysis

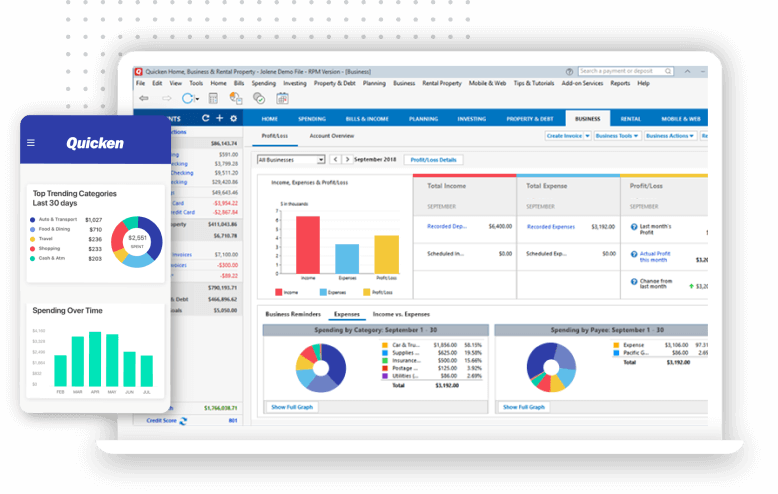

When it comes to generating reports and visualizing my financial data, Quicken offers more options.

It produces pie charts and bar graphs, letting me compare my current spending to previous months or years.

Mint, however, focuses more on goal tracking by offering a single-page financial goal tracker to monitor my progress.

Overall, both Mint and Quicken offer robust personal finance tools to help me streamline my financial management.

My choice between the two depends on the specific features and level of detail I require in managing my money.

Pricing and Plans

When comparing Mint and Quicken, one of the first things that caught my attention was the difference in their pricing structures.

Mint is a free service, but it does have some drawbacks like ads and the collection and selling of user data.

However, for a budgeting tool at no cost, it’s still a popular choice for many users.

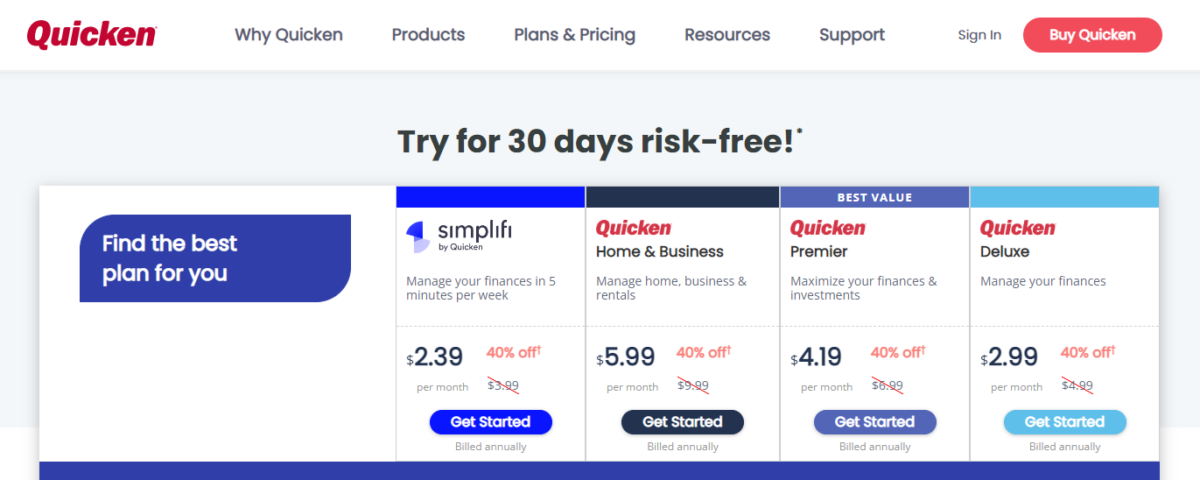

Quicken, on the other hand, utilizes an annual subscription model. Their pricing tiers range from $41.88 to $119.88 per year, depending on the plan you choose.

Now, while this may seem like a significant investment, it’s essential to consider the features and tools you’ll be getting in return for the price.

Here’s a breakdown of Quicken’s plan options:

- Starter Edition: This is the most basic plan that covers essentials like budgeting, bill tracking, and categorizing expenses. It’s suitable for those new to personal finance management.

- Deluxe: In addition to the features available in the Starter Edition, it also offers debt management and savings goals. This plan is popular among users looking for more financial planning tools.

- Premier: With the Premier plan, you will get all the features of the Deluxe, plus additional features like investment tracking, tax planning, and access to priority customer support.

- Home & Business: This plan is designed for small business owners who want to manage both their personal and business finances. It includes all the features of the Premier plan along with business-specific tools like invoicing and expense tracking.

When it comes to hidden fees, I couldn’t find any specific ones tied to any of the Quicken plans, which is a positive aspect.

Mint, being a free service, obviously does not have hidden fees either.

However, one thing to note is that Mint’s revenue generation through ads and selling data can indirectly affect users.

The user experience might have ads, and your spending and savings habits data may be shared with third parties.

To summarize, Mint is a free platform, while Quicken requires an annual subscription. Each Quicken plan offers additional features that cater to different user needs.

Security and Privacy

When it comes to security and privacy, I find both Mint and Quicken take these matters seriously.

They have implemented several measures to ensure the protection of users’ financial data.

First, both Mint and Quicken employ robust security measures such as 256-bit encryption to keep our financial information secure.

This encryption level is the same used by banks and financial institutions, so it’s reassuring to know that our data is well protected.

In addition, both platforms have firewall protection in place. These firewalls act as a barrier between our personal financial data and potential outside threats.

As a result, it’s more difficult for cybercriminals to access or compromise our accounts.

I also appreciate the password protection features offered by both Mint and Quicken. They encourage us to create strong and unique passwords to further secure our accounts.

Additionally, they offer two-factor authentication (2FA) as an added layer of security.

With 2FA enabled, even if someone were to discover our passwords, they’d still need a secondary method of verification (like a text message code) to gain access to our accounts.

When it comes to accessibility, I find it worth mentioning that Mint is a web-based platform, whereas Quicken has both a web-based version and a desktop application.

This means we can access Mint from any device with an internet connection, while Quicken can be accessed both online and offline through its desktop version.

This difference in accessibility could be important for some users, so it’s something to keep in mind when considering security and privacy preferences.

As a user, I believe that both Mint and Quicken prioritize security and privacy by implementing measures like encryption, firewalls, password protection, and two-factor authentication.

Additionally, their differences in accessibility cater to various user preferences, ensuring a secure and user-friendly experience for everyone.

Customer Support and Accessibility

When it comes to customer support, I found that Quicken has a much better reputation.

They offer phone support at 650-250-1900, available from 5AM to 5PM PT, Monday – Friday.

I appreciate being able to call and talk to a real, live person, and I heard that wait times are usually not too long.

Additionally, Quicken Premier subscribers get access to Premium Support services.

As for Mint, I didn’t find any information about their customer support offerings through phone or email, but their website does have an extensive help center with articles and FAQs that could be helpful to many users.

When I looked into accessibility, I noticed that one of the main differences between Mint and Quicken is how users access the two programs.

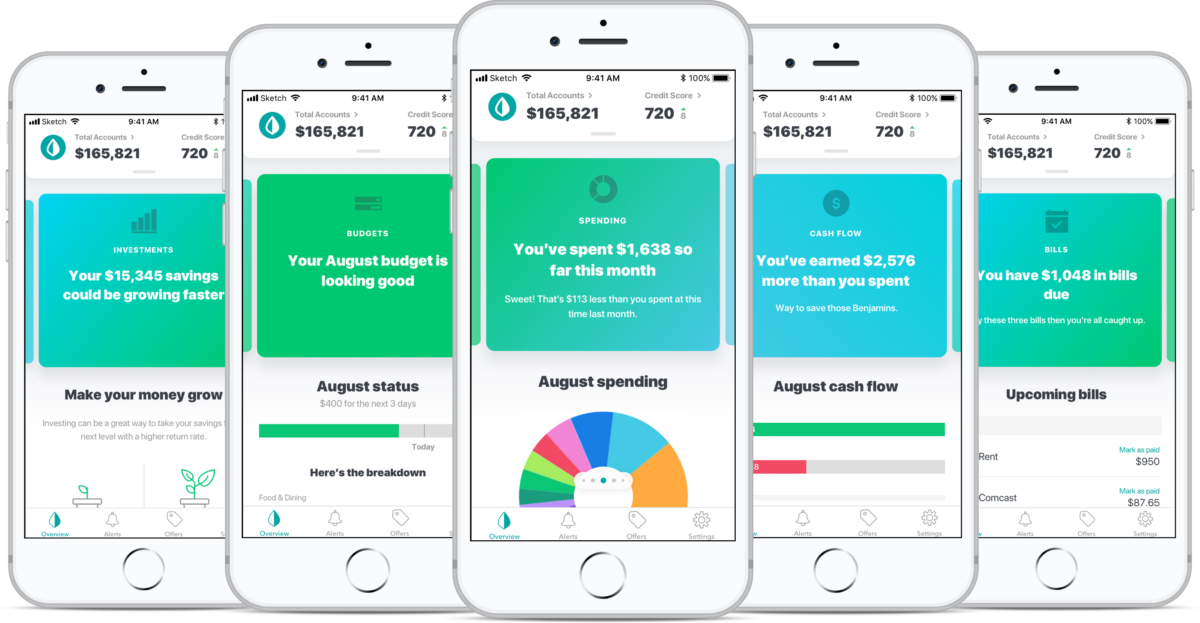

While Mint can be accessed from a desktop, many users, including myself, prefer to use their mobile app for on-the-go finance management.

Mint’s app is available on both iOS and Android devices, making it convenient for a majority of smartphone users.

Quicken, on the other hand, offers a more comprehensive desktop software experience.

It’s ideal for users who prefer to manage their finances through locally-installed software.

Although they do provide a mobile app as an extension of the desktop software, it doesn’t seem to be as user-friendly as Mint’s mobile app.

Here’s a quick comparison of customer support and accessibility for both Mint and Quicken:

| Feature | Mint | Quicken |

|---|---|---|

| Customer Support | Help center with FAQs | Phone support, Email support (for Premier subscribers) |

| Accessibility | Desktop and mobile app | Desktop software, Mobile app (extension) |

Mobile Experience

When it comes to the mobile experience, both Quicken and Mint offer companion apps for iOS and Android devices.

I found that each app has its strengths and weaknesses, depending on my needs at any given time.

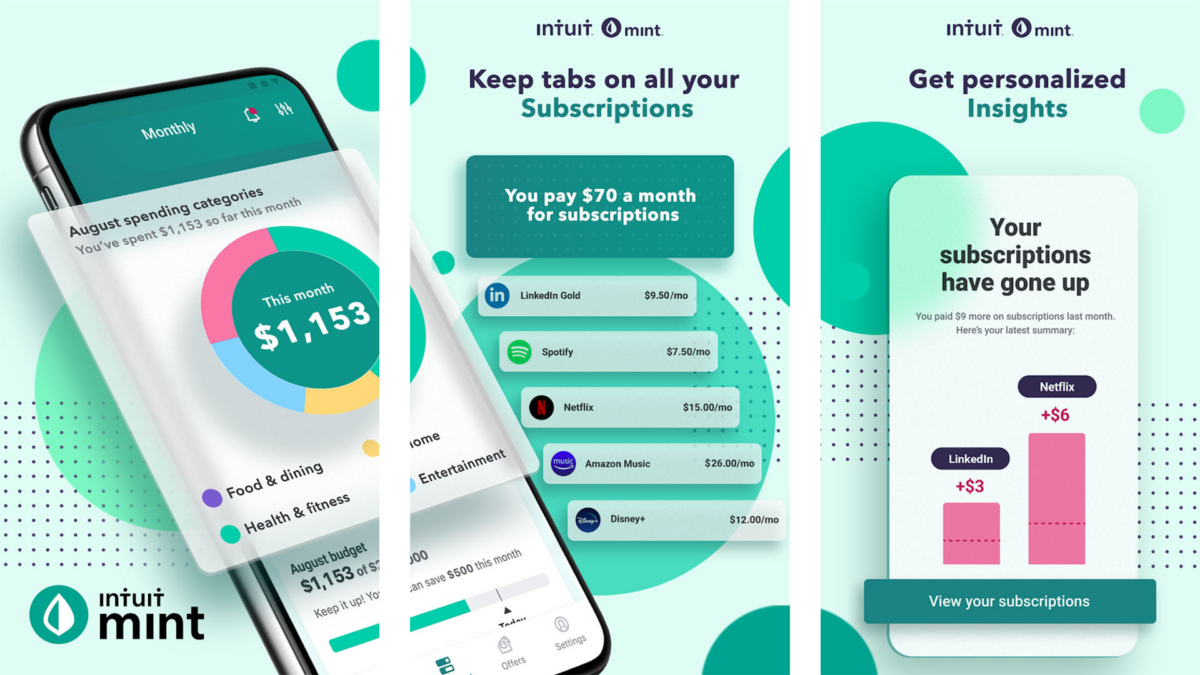

In terms of design and usability, Mint’s app has a clean and straightforward interface that makes it easy to navigate.

I can quickly view my account balances, recent transactions, and spending trends on the app’s main dashboard.

The app also sends me push notifications for upcoming bills, which helps me stay on top of my financial obligations.

Quicken’s app, on the other hand, closely resembles its desktop counterpart in terms of features and layout.

It allows me to manage my budget, investments, and even property-related finances using my mobile device.

Though the app can be a bit cluttered at times, I appreciate the robust feature set available on the go.

As an Apple user, I found it helpful that both apps have seamless integration with other iOS features, such as Siri functionality and Face ID authentication.

These integrations make it easy for me to access my financial data securely and perform voice-activated actions within the apps.

Here’s a quick comparison of some key features for both apps:

| Mint App | Quicken App |

|---|---|

| Clean, intuitive interface | Robust feature set |

| Push notifications for bill reminders | Offers investment tracking |

| Seamless iOS integrations (Siri, Face ID) | Supports property management |

In terms of compatibility, both Mint and Quicken apps are available for free on the Apple App Store and Google Play Store.

However, keep in mind that Quicken requires an annual subscription to access its features, while Mint’s platform is free but ad-supported.

Overall, my experience with the mobile apps for Mint and Quicken has been positive.

Each app offers valuable services and tools that help me manage my finances effectively, whether I’m at home or on the go.

Pros and Cons

In my experience using both Quicken and Mint, I’ve seen that they each have their own pros and cons.

Let me break it down for you in a few paragraphs.

Mint

Pros

- Mint is free to use, which is a significant advantage for those looking for a budgeting tool at no cost.

- It’s very user-friendly, making it easy for beginners to navigate and understand their finances.

- You can connect all your accounts, including bank accounts, credit cards, and even investments, making it convenient to have all your financial information in one place.

Cons

- Since it’s free, Mint relies on advertisements, which can be annoying for users.

- Mint also collects and sells data about consumer spending and savings habits, raising privacy concerns for some users.

Quicken

Pros

- Quicken offers a more comprehensive set of tools for managing your budget and tracking investments.

- It comes with an annual subscription fee, but the tools provided justify the price, which ranges from $28.68 to $71.88 per year, depending on the plan.

- Quicken’s features are more advanced than Mint’s, catering to users looking for a more in-depth analysis of their finances.

Cons

- The annual subscription fee could be a deterrent for those on a tight budget or not willing to pay for a budgeting app.

- Quicken’s Mac version lacks some features compared to the PC version, making it less appealing to Mac users.

Mint and Quicken have their own unique benefits and drawbacks, depending on the user’s needs and preferences.

Some users might prefer Mint’s simplicity and free services, while others might lean towards Quicken for its robust features and in-depth financial analysis.

Alternatives and Competitors

When discussing Quicken and Mint, there are quite a few alternatives and competitors in the budgeting software space.

Some have their own unique features and benefits that cater to various financial requirements. Let me walk you through some of them.

My personal favorite alternative to Quicken is Personal Capital.

It offers a comprehensive financial dashboard, making it more than just a simple budgeting app.

With Personal Capital, I can manage and plan for my financial life effectively. It’s also taken the top spot as a Quicken alternative in a number of reviews.

Another great option I came across is Simplifi by Quicken. This app combines an elegant, intuitive interface with robust tools to track my spending and plan for future expenses.

Simplifi is highly recommended for most people, according to some reviews.

You Need a Budget (YNAB) is another popular choice I found among budgeting enthusiasts.

It helps me allocate every dollar I earn to a specific purpose, making sure I’m spending mindfully and saving effectively.

Many users swear by this app and its unique methodology.

EveryDollar is a budgeting app created by financial expert Dave Ramsey. It follows his popular “7 Baby Steps” approach to personal finance.

I like how it focuses on giving every dollar a job and encourages me to prioritize my spending according to my financial goals.

Empower is another interesting alternative I discovered, which focuses on enabling smart spending habits and helping me gain better control over my finances.

The app allows me to track my spending, create monthly budgets, and set savings goals.

As for PocketGuard, I find it really useful for staying on top of my budget and avoiding overspending.

It’s a freemium budgeting app with an easy-to-use interface that streamlines my financial management.

Lastly, there’s PocketSmith, a powerful and customizable personal finance software.

It allows me to forecast my future cash flow, making it uniquely suited for longer-term financial planning.

To sum up, here’s a quick list of the alternatives and competitors I mentioned:

- Personal Capital

- Simplifi by Quicken

- You Need a Budget (YNAB)

- EveryDollar

- Empower

- PocketGuard

- PocketSmith

There are many options available to find the perfect budgeting software that suits my needs, and hopefully yours as well.

Conclusion

In my experience with Quicken vs Mint, each offers its own set of advantages and drawbacks in 2024.

When it comes to budgeting and managing finances, both tools have very similar capabilities.

They allow users to track expenses, manage accounts, and plan for future expenses, making them valuable tools for managing money.

Mint is a free budgeting platform but requires users to tolerate ads and give up some data privacy.

Despite this, it offers a user-friendly, easy-to-navigate interface that helps monitor expenses and keep financial goals on track.

Pros and Cons of Mint

Pros

- Free to use

- User-friendly interface

- Good expense tracking tools

Cons

- Contains ads

- Collects and sells user data

Quicken, on the other hand, has an annual subscription fee ranging from $41.88 to $119.88.

This cost provides access to more robust tools and advanced features.

Unlike Mint, Quicken does not sell personal data, giving users more control over their privacy.

The software may be more suitable for those willing to pay for added features and control over their data.

Pros and Cons of Quicken

Pros

- More advanced features

- Does not sell user data

- Annual subscription model

Cons

- Requires payment

- Costs can be a barrier for some users

As I see it, the choice between Mint vs Quicken comes down to personal preferences, budget, and desired level of control over data privacy.

For a free, user-friendly option, Mint is a solid choice.

For those willing to invest in more advanced features and maintain data privacy, Quicken may be a better choice.

Ultimately, the best budgeting app for any individual depends on their specific needs and priorities.