In 2014, NFTs (non-fungible tokens) were created. However, it wasn’t until 2021 that NFTs took the globe by storm.

In the next several paragraphs, we will share some interesting and useful NFT statistics for 2024 for you.

We will address whether NFTs are still popular and if they will be going into 2024.

We’ll also answer questions regarding which NFT is the most expensive digital asset of all and many other questions you may have or have had.

We have compiled a large number of statistics about NFTs for the following lists. These key statistics and facts are compiled from a variety of reliable resources across the web.

We strive to be as accurate and up to date as possible with the most current data we can find.

Let’s get into this!

Post Contents

- 1 Key NFT Statistics

- 2 NFT Market Size Statistics

- 2.1 1. NFTs Amassed More than $25 Billion in Trades in 2021.

- 2.2 2. Despite the Market Crash in 2022, NFT Sales Still Almost Matched Those in 2021.

- 2.3 3. The NFT Market Value Is Expected to Reach Over $80 Billion (USD) by 2025.

- 2.4 4. In 2021, Roughly 28.6 Million Wallets Traded NFTs.

- 2.5 5. NFT Market Growth Is Predicted to Achieve $147.24 Billion Between 2021 and 2026.

- 2.6 6. In 2021, Nearly 14 Million in Sales Across Segments Occurred.

- 2.7 7. The First Quarter of 2022 Saw 950,000 Distinct Addresses Buying or Selling an NFT.

- 2.8 8. By May 1, 2022, Collectors Sent $37 Billion to NFT Marketplaces.

- 2.9 9. Most NFT Transactions Belong to The Retail-Sized Transactions, Which Consists of Transactions of Under $10,000 in Digital Assets.

- 2.10 10. In May 2022, the WSJ reported that the NFT market was collapsing.

- 3 NFT Sales Statistics

- 3.1 11. Global NFTSales in March Came to Over $735 Million for The Month.

- 3.2 12. In 2021, There Were More than 1.5 Million NFT Art Pieces Sold in One Month.

- 3.3 13. In 2020, the Combined Floor Market Cap Value of The Top 100 NFTs Ever Released Came to $16.7 Billion.

- 3.4 14. CryptoPunk #7523 Sold for $11.7 Million in June 2021.

- 3.5 15. CryptoPunk #5822 Is the Most Expensive Sale for This NFT Asset at $23 Million in February 2022.

- 3.6 16. The Most Expensive NFT Sale for 2021 Was Auctioned Off and Brought $69.3 Million.

- 3.7 17. In December 2021, the Most Expensive NFT Collection Sold for $91.8 Million (USD).

- 4 NFT Demographics

- 4.1 18. Millennials Are More Apt to Be Collectors of NFTs at 23%.

- 4.2 19. A Poll of Collectors of Physical Items Shows that 51% Are Interested In NFTs.

- 4.3 20. 15% of Men Who Are Collectors of Physical Items Are Likely to Collect NFTs.

- 4.4 21. Singapore Shows the Highest NFT Ownership Percentages Among the 18 to 34 Age Demographics.

- 4.5 22. Statistics Show that The Country Most Interested in NFTs Is China.

- 5 NFT Adoption Rate Statistics

- 6 The Costs of NFTs

- 7 Bonus NFT Statistics

- 7.1 27. OpenSea Ranks First in The List of Best NFT Marketplaces.

- 7.2 28. Over 50% of Documented NFT Sales Are Reported at Under $200.

- 7.3 29. In 2021, Nyan Cat NFT Sold for Roughly $590,000, Which is 300 ETH.

- 7.4 30. In The Third Quarter of 2022, There Were 903,259 Buyers versus 635,258 Sellers in The NFT Space.

- 8 FAQs

- 9 Conclusion

- 10 Sources

Key NFT Statistics

- NFTs amassed more than $25 billion in trades in 2021.

- Despite the market crash in 2022, NFT sales still almost matched those in 2021.

- The NFT market value is expected to reach over $80 billion (USD) by 2025.

- In 2021, roughly 28.6 million wallets traded NFTs.

- NFT market growth is predicted to achieve $147.24 billion between 2021 and 2026.

- In 2021, there were more than 1.5 million NFT art pieces sold in one month.

- The most expensive NFT sale for 2021 was auctioned off and brought $69.3 million.

- Singapore shows the highest NFT ownership percentages among the 18 to 34 age demographics.

- India is the world’s top adopter of NFTs.

- The cost of minting and selling NFTs ranges in costs of $70 and over $150.

NFT Market Size Statistics

First, we will address NFTs as a market. We will discuss where it’s been and where it’s going.

1. NFTs Amassed More than $25 Billion in Trades in 2021.

Statistics show that in 2021, the NFT space enjoyed the most significant growth overall at more than $23 billion in trades.

It was in 2021 that NFTs began to be considered like collectibles and artwork.

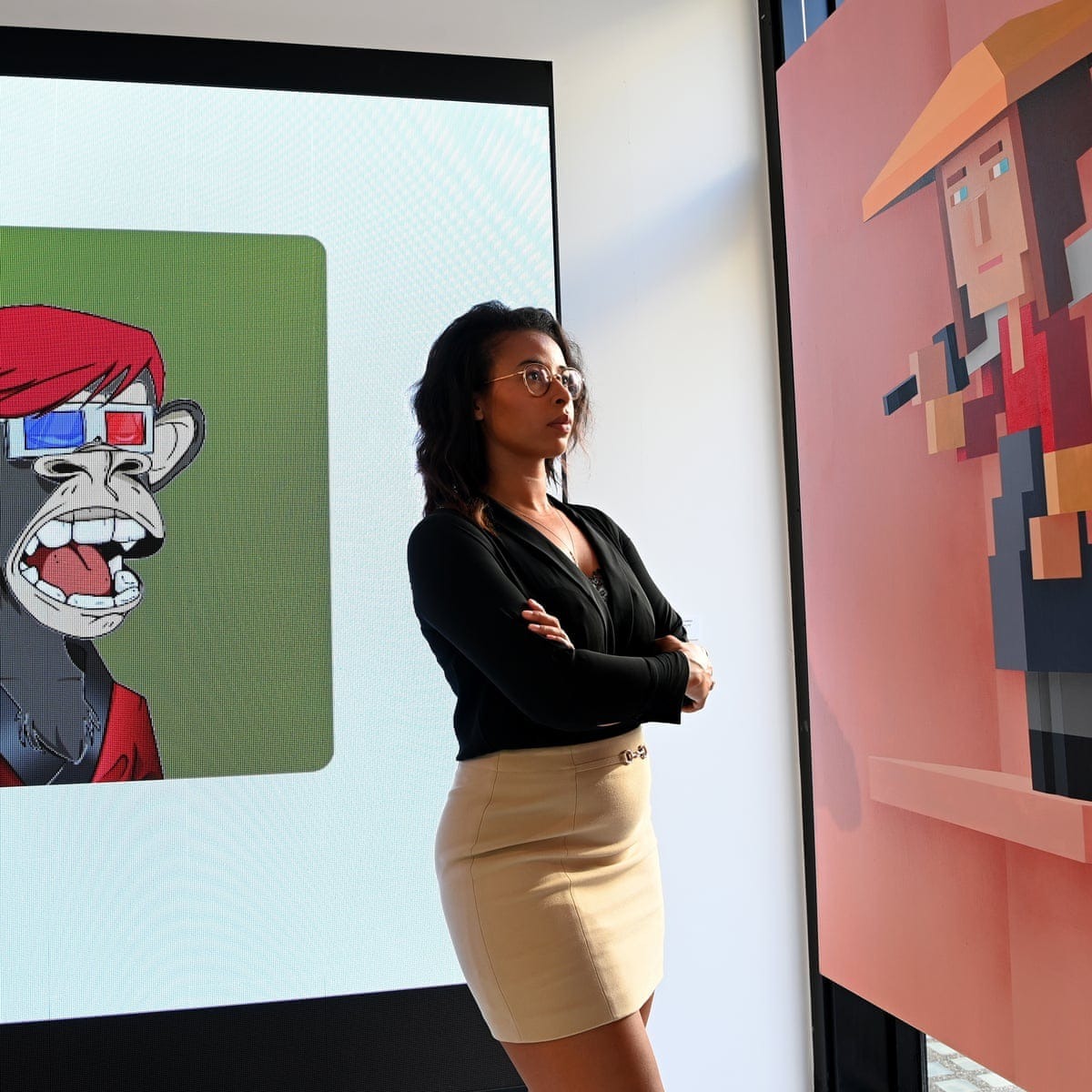

Art Blocks, Bored Ape Yacht Club (BAYC), and CryptoPunks arose as the face of the NFT space and contributed to its rise.

Big brand names, celebrities, and other well-known people and entities aided the growth of this digital asset space.

Overall, NFTs have positively and intensely impacted the realm.

(Reuters 2022)

2. Despite the Market Crash in 2022, NFT Sales Still Almost Matched Those in 2021.

Even in the wake of a market crash, NFTs stood up to a strong year-end result of $24.7 billion in organic trading.

These trades were made across multiple blockchain platforms.

The NFT market took a dive over 2022 until the last bit of the year when it made a huge comeback.

The overall cryptocurrency took a huge loss, which by May saw the collapse of Terra’s UST and LUNA coins.

While cryptocurrency and NFTs are different, they both fall under the digital assets industry. Therefore, NFTs also suffered similar losses throughout 2022.

What will 2023 hold for digital assets, and specifically NFTS?

(Decrypt 2023)

3. The NFT Market Value Is Expected to Reach Over $80 Billion (USD) by 2025.

According to Nasdaq News & Insights 2022, the current market value of NFTs is $35 billion.

The NFT market is expected to reach $80 billion in 2025. NFTs are one of the top five blockchain investments recommended by Nasdaq experts.

Also, analysts from the global investment bank have doubled down on their forecast with regards to NFTs, according to CoinDesk.

One of the things that was used to come up with these figures is that big name brands have plans to expand their audience reach by tapping into the digital asset world.

This data comes from Jefferies, a financial services company.

(CoinDesk 2022, Nasdaq 2022)

4. In 2021, Roughly 28.6 Million Wallets Traded NFTs.

The 28.6 million wallets traded in 2021 is a rise from 2020 when there were 545,000 wallets known to trade NFTs.

The growth in NFT trading has as much to do with more people being online as it does with more people joining the ranks of digital asset ownership, exchanging, and trading.

As Gen Z comes of age, there’s little doubt that there will be growth in digital assets, including NFTs.

Who knows how far things will go in future generations? It’s important to know that 10% of NFT traders make up a total of 85% of all NFT transactions.

Regardless of how “small” this seems, there’s evidence that the NFT space is growing.

(Reuters)

5. NFT Market Growth Is Predicted to Achieve $147.24 Billion Between 2021 and 2026.

In June 2022, the NFT market was growing at a CAGR of 35.27%.

This growth aligns with the incremental expansion expectations of $147.24 billion (USD) between 2021 and 2026.

One of the things driving the growth are key players who want more digital artworks to collect.

It’s believed that 43% of the NFT market growth will come from the Asia-Pacific region (APAC).

Besides the Asia-Pacific, other regions where NFT growth is expected include South America, Europe, the Middle East, North America, and Africa.

The overall year-over-year growth is 30.72% for 2022.

(PR Newswire: technavio 2022)

6. In 2021, Nearly 14 Million in Sales Across Segments Occurred.

Besides NFTs being traded, NFTs are also bought and sold.

In 2021, $13,981,900 in NFTs sales happened across several segments. Here’s a breakdown of these segments.

- Collectibles: $7,130,000

- Game: $1,153,820

- Art: $2,107,570

- Undefined: $1,864,220

- Metaverse: $630.990

- Utility: $75.500

- DeFi: $19,750

When you compare these segments and the overall sales of NFTs from 2018 to 2021, you can see the growth.

For instance, in 2020, across all segments, $66,780 sales were made across NFT segments.

Remember, these figures relate to sales, not trades.

(Statista)

7. The First Quarter of 2022 Saw 950,000 Distinct Addresses Buying or Selling an NFT.

The figure in the first quarter of 2022 of 950,000 unique wallets that bought or sold an NFT is a rise over the fourth quarter of 2021 when that figure accounted for 627,000 wallets.

Across the NFT space, the number of active buyers and sellers of NFTs has grown every quarter from the second quarter of 2020.

In the second quarter of 2022, May figures show that 491,000 unique addresses have made transactions in the NFT market.

This data resulted in placing the NFT sector on point for quarterly growth in participants.

Despite recorded fluctuations in the NFT market, it continues to grow in sellers and buyers.

(Chainalysis)

8. By May 1, 2022, Collectors Sent $37 Billion to NFT Marketplaces.

In May 2022, NFT collectors sent more than $37 billion to the space’s marketplaces. This data puts them on track to beat the $40 billion sent through in 2021.

Due to market fluctuations, which are expected in the digital assets realm, it went flat in the summer of 2021.

If not for the two large spikes in fluctuations late in August and another that spanned from late in January up to early February of 2022, the figures would not have been nearly as good as they were.

However, soon after that last spike in 2022, NFT activities saw a significant decline before seeing new activity later in 2022.

(Chainalysis)

9. Most NFT Transactions Belong to The Retail-Sized Transactions, Which Consists of Transactions of Under $10,000 in Digital Assets.

Between 2021 and 2022, it was reported that the majority of NFT transactions were at the retail size.

Retail sized transactions account for those with under $10,000 worth of cryptocurrency.

Collector-sized transactions that are between $10,000 and $100,000 account for the largest volume in transactions due to the amount spent.

When you look at this in monetary volume, collectors make up those driving NFT transactions the most.

The institutional-sized transfers account for 33% of all activity. It’s important to know that institutional-sized growth is inconsistent.

(Chainalysis)

10. In May 2022, the WSJ reported that the NFT market was collapsing.

According to this article, NFT sales were believed to be flattening in May 2022.

Sales of non-fungible tokens fell to an average daily number of 19,000 during the first week of May 2022.

This number represented a 90% decline from its September 2021 peak at 225,000.

The Wall Street Journal gathered data from the NonFungile website. Even the number of active wallets fell by 88%.

Furthermore, the article cited that several NFT owners were discovering that their initial investments were worth much less than when they bought them.

Obviously, the NFT market didn’t collapse since people are still transacting in this space in 2023.

(WSJ 2022)

NFT Sales Statistics

While we discussed some NFT sales data in the market section, we have more sales data to share with you in this section.

11. Global NFTSales in March Came to Over $735 Million for The Month.

Global NFT sales show that in March 2023, monthly sales across the globe came to $735,994,985.97 (USD).

The average sale came to $109.81 (USD). The total number of transactions that made up these monthly sales was 6,702,228. Also, there were 833,683 unique buyers and 550,599 unique sellers.

In November 2021, NFT sales were over $3 billion for the month. In fact, between September 2021 and May 2022, monthly NFT sales ranged between $3,224,449,425.32 billion and over $6.4 billion per month.

Since May 2022, numbers of this significance haven’t been seen, though the NFT market is still in growth after the near collapse.

So far, April 2023 sales account for over $170 million.

(Crypto Slam, Statista 2)

12. In 2021, There Were More than 1.5 Million NFT Art Pieces Sold in One Month.

In just a single month, between October and November 2021, NFT art sales came to more than 1.5 million.

If you were into creating NFTs during that month, you may have had a very good month in sales with a one-month total of 1.538 million in art sales.

To put this into perspective, in all of 2021 11 million NFT art sales were transacted.

Obviously, the month between October and November 2021 had a significant impact on 2021’s overall NFT art sales figures.

Keep in mind that NFT art pieces are only one segment of the NFT space.

(NonFungible)

13. In 2020, the Combined Floor Market Cap Value of The Top 100 NFTs Ever Released Came to $16.7 Billion.

When measured collectively, the first 100 NFTs released had a value of $16.7 billion in 2020.

This massive figure is directly connected to the Ape Yacht Club, Bored Ape, and CryptoPunk avatars.

These became highly collectible, which made them newsworthy all over the globe.

It shouldn’t come as a surprise that these first NFTs minted have and do sell at such high prices being the first of their kind in the NFT space.

It’s statistics like this that boost NFTs credibility, popularity, and value.

Bored Ape #3739 was sold in September 2021 for $2.9 million and is considered the 27th rarest ape.

(The Guardian)

14. CryptoPunk #7523 Sold for $11.7 Million in June 2021.

CryptoPunk NFTs were responsible for several sales in the market in 2021. Larva Labs is the name of the artist of the line of CryptoPunk artworks in the NFT space. In June 2021, CryptoPunk #7523, better known as “COVID Alien” because it has a face mask, sold at a whopping $11.7 million.

In Ethereum, the sales amounted to 4700 ETH. The Covid Alien piece is considered the biggest punk sale of 2021. Because it happened as part of the Sotheby Natively Digital auction in June 2021, the blockchain itself doesn’t display this enormous sale.

It’s believed that this sale has helped and will help encourage the mainstream adoption of NFTs.

(NFT Now)

15. CryptoPunk #5822 Is the Most Expensive Sale for This NFT Asset at $23 Million in February 2022.

The most expensive CryptoPunk ever sold is $58222, which is an alien-style punk figure with a blue bandana on its head.

It sold in February 2022 for $23 million, which represents 8000 ETH. Notice that this is more than double #7523.

Who bought it? Deepak Thaplyal, the CEO of Chain. Soon after the purchase, Deepak tweeted an image of his newly acquired NFT.

It got close to being the number one most expensive NFT sale, but it ranked at number four. It was only a few million short of number one.

It’s valuable since it’s one of only nine aliens that were minted for this collection. It’s not surprising that it would bring a big sale.

(NFT Now)

16. The Most Expensive NFT Sale for 2021 Was Auctioned Off and Brought $69.3 Million.

This NFT is called The first 5000 Days, which is a digital collage by Bepple.

How much in Ethereum is that? $69.3 million is equal to 38525 ETH.

Beeple is the pseudonym for Mike Winkelmann, who is a digital artist. The $69.3 million sale for this NFT artwork makes it one of the most valuable artworks ever sold by a living artist.

It sold in March 2021. Its value occurred due to its mainstream exposure and even a spot-on SNL.

Likewise, Human One, an art piece by Beeple NFT sold for $29 million.

(NFT Now)

17. In December 2021, the Most Expensive NFT Collection Sold for $91.8 Million (USD).

Just what is this NFT collection that sold for $91.8 million? It’s called “The Merge”, by Pak, a digital artist who has grossed more than $350 million for their art.

The purchase of The Merge included 28,983 people who managed to grab 312,000 NFT shares of the collection.

The starting prices of each piece started at $575, which increased every six hours by $25. Pak has become history’s most valuable living artist.

Jeff Koon, artist of Rabbit, the painting, had the title since 1986 when his art sold for $91 million.

(Sensorium)

NFT Demographics

In this section, we’ll discuss the demographics of NFT buyers, traders, sellers, etc.

18. Millennials Are More Apt to Be Collectors of NFTs at 23%.

A Morning Consult poll in 2022 showed that Millennials make up the largest percentage of those who are likely to be NFT collectors at 23%.

Millennials also came out on top among other generations as those most likely to be collectors in general at 42%. This survey included 2,200 American adults.

Also, one out of every three American adults said they collect physical things as an investment or a hobby.

Of these collectors, 10% claimed to be enthusiastic collectors, while another 20% said they were former collectors.

Only 8% of Gen Xers, 4% of Gen Zers, and 2% of Boomers collect NFTS.

(Morning Consult, Morning Consult Poll)

19. A Poll of Collectors of Physical Items Shows that 51% Are Interested In NFTs.

From the same Morning Consult poll, we also learned that when asked if they would be interested in acquiring, trading, or investing in NFTs in the future, 31% said they are somewhat interested and 20% said they are very interested.

Therefore, 51% of physical collectors surveyed are interested in non-fungible tokens sometime in the future.

Of all adults who are physical collectors, 29% said they are either very or somewhat interested in NFTs. Sports fans make up 34% and gamers 37% of this same group surveyed.

Esports fans showed the most interest in NFTs of this poll at 58%.

(Morning Consult, Morning Consult Poll)

20. 15% of Men Who Are Collectors of Physical Items Are Likely to Collect NFTs.

Men have the market share in this Morning Consult Poll about collectors who are interested in NFTs. At 45%, men are more apt to be collectors, which includes 15% who are interested in collecting NFTs.

In contrast, women hold the market share of 22% who are apt to be collectors, including 4% of them being interested in collecting NFTS.

In this survey, male participants said that they are three times as likely to consider themselves collectors than women.

There is a disparity between genders in this survey. According to the co-founder of Reddit, Alexis Ohanian, “Women-as-investors in these assets will change the game.” She tweeted this thought.

Overall, this data suggests that men are twice as likely to consider themselves collectors.

(Morning Consult, Morning Consult Poll)

21. Singapore Shows the Highest NFT Ownership Percentages Among the 18 to 34 Age Demographics.

Statistics show a lot of data across age groups and countries. We will address a few here.

Singapore has 9% in NFT ownership among the 18 to 34 age group. It has 4% of the 35 to 54 age group and 3% of the 55 and over age group.

India is second with 8% among the 18 to 34 age group, but they have the share of the 34 to 54 crowd at 7%.

India has 5% of the 55 and over age group, which is the same as Hong Kong and Kenya.

The United States takes third in NFT ownership among those between 18 and 34 years old at 5%.

Among those aged 35 and 54, the United States has 3% of the share and the 55 and older group is negligible.

Each country has its own share of NFT ownership respectively.

(Finder)

22. Statistics Show that The Country Most Interested in NFTs Is China.

According to 2023 data, people in China search the keyword NFT more than other countries of the world. This data was compiled via Google Trends by Statista.

Between July 2022 and November 2022, searches for NFTs in China occurred 100 times per month.

The city of Hong Kong alone searched the term NFT 100 times in August 2022 and 94 times in November 2022.

Singapore follows China and Hong Kong SAR with 66 to 100 searches for NFTs between December 2021 and November 2022.

Other countries that follow Singapore include Gibraltar, Macao, Cayman Islands, Nigeria, Andorra, etc. From this data, we can surmise that consumers from Asia and the Oceania regions show the most interest in NFTs.

For reference, searches for the term NFT in the United States were 52 (February 2022) and under between December 2021 (48) and November 2022 (33)

(Statista 3)

NFT Adoption Rate Statistics

23. India Is the World’s Top Adopter of NFTs.

India has the highest NFT adoption rate at 7%. Vietnam is on India’s heels at 6% and Hong Kong and Singapore are tied at 5%.

In contrast, Germany is at the lowest on the NFT adoption rate table at 1%, with the United Kingdom, Sweden, Norway, New Zealand, Japan, Colombia, Mexico, South Africa, Canada, Australia, and Argentina tied at 2%.

After Singapore, Brazil, Ghana, Indonesia, Nigeria, and the Philippines have a 4% NFT adoption rate.

The United States has a 3% NFT adoption rate, which is the same as Ireland, Kenya, Malaysia, and Venezuela.

These figures represent the global NFT adoption table by rank.

Overall, the global average falls at 3%.

(Finder)

24. It’s Predicted that The United States NFT Adoption Rate Will Reach 6.7% Based on A 2021 Poll.

Research shows that 2.8% of people in America using the internet own at least an NFT, and some own two or more.

An online poll of over 28,000 individuals across 20 different countries was used to gather this data.

It revealed that the United States ranks third last for the adoption of NFTs.

However, the poll also uncovered that the adoption rate in American will more than double with the data gathered about those interested in acquiring NFTS in the future.

In fact, 3.9% said they were planning to own NFTs.

So far, the highest NFT adopters in the United States range from 18 to 34 years old.

(Finder)

The Costs of NFTs

What are the costs of creating, buying, and selling NFTs? Let’s see what the NFT statistics say.

25. The Cost of Minting and Selling NFTs Ranges in Costs of $70 and Over $150.

Many digital NFT artists lose money when they are generating cryptographics for NFTs. They pay NFT fees to the NFT marketplaces, which are calculated by supply and demand.

Therefore, the costs can widely vary. It’s difficult to predict with any accuracy the precise cost of minting and selling NFTs.

Some of the fees that are accrued include gas fees for minting NFTs. Also, whatever the marketplace fees are.

For instance, SuperRare, an NFT marketplace charges $70 to mint a $100 NFT.

SuperRate takes $15 of the $100 sale price.

The total fees on this marketplace (subject to change) for an NFT one plans to charge $100 for come to $85.

This leaves the digital artist with $15 in profit, which is an 85% loss.

These numbers are only one example of the cost of minting and selling NFTs.

Costs will range with the marketplace fees, gas fees, and any other related fees relevant to your NFT type.

Obviously, it’s wise to find the lowest fees if you’re intending to design NFTs to sell.

Before the NFT market crashed in April 2021, this opportunity gave digital artists hope.

We hope that hope is returned to them soon.

(Medium)

26. As of December 2021, Most New NFT Collectors on The Secondary NFT Market Haven’t Recovered Their Purchase Costs.

A Financial Times study showed that this group of people made up an overwhelming number of NFT collectors.

What’s preventing NFT collectors from recouping their NFT investment costs?

Sadly, it’s mostly due to the fact that buying NFTs is a confusing ideal, so most new collectors were and are still on a rigid learning curve.

They need to learn more to correctly buy and sell NFTs.

Without knowledge of how NFTs work, collectors will continue to have problems with investment recovery.

(Financial Times)

Bonus NFT Statistics

Here are some more bonus statistics you may find interesting.

27. OpenSea Ranks First in The List of Best NFT Marketplaces.

According to Motley Fool, OpenSea is the best NFT marketplace. First, this marketplace has a low 2.5% transaction fee.

Also, OpenSea is compatible with a wide range of NFTs such as art, collectibles, domain names, music, photography, sports, trading cards, utility, and virtual worlds.

According to the information, this marketplace offers more pros than cons. It also supports more than 10 NFT wallets like Coinbase, Metamask, Trust Wallet, and Wallet.

OpenSea accepts several methods of payment such as Ethereum, USD, USDC, Dai, Solana, and WETH.

The OpenSea platform is worth $13.3 billion as of early 2022. About 250,000 million people trade NFTS on this marketplace each month.

In May 2022, the sales volume of NFTs dropped by 75% because of top-selling NFTs price slippage.

Most of the reviews for OpenSea say this is the best NFT marketplace. The only downside is that due to its success, it has started to attract some plagiarism and scams.

(Motley Fool)

28. Over 50% of Documented NFT Sales Are Reported at Under $200.

If you’ve read the hype about NFTs and all the millionaires the space is making, you should know that more than half of all NFT sales are less than $200.

Don’t get us wrong, there are obviously NFTs that have sold for thousands to millions of dollars in the NFT space. It’s just that most are under $200.

In fact, according to our research, most primary sales of NFTs were under $100.

As of the third quarter of 2022, the average selling price of NFTs came to $150 per NFT sold.

Reports like this are helpful to digital artists who want to get in on the NFT trend.

They deserve to know and understand that NFTs on average don’t make you a millionaire.

So, if money is the objective, you may not see much profit from making NFTs.

(Influencer Marketing Hub)

29. In 2021, Nyan Cat NFT Sold for Roughly $590,000, Which is 300 ETH.

A CoinDesk article that made it to Yahoo reported that the NFT Nyan Cat sold for about $590,000, or 300

ETH. According to this article, this sale opened the door to the “meme economy”. Chris Torres, the creator of Nyan Cat created this meme in 2011.

This creation was the digital artist’s first try at the NFT market, so we can only imagine how exciting it was to sell it for over half a million dollars.

According to Torres, the sale happened on Foundation, a crypto art platform.

The bidding on Nyan Cat started at 3 ETH.

(Yahoo 2021)

30. In The Third Quarter of 2022, There Were 903,259 Buyers versus 635,258 Sellers in The NFT Space.

According to the data, there are more buyers than sellers in the NFT space. In 2022’s third quarter, there were 903,259 buyers compared to 635,258 sellers on the NFT marketplaces.

It’s important to note that the buyer’s database was down by 22% from the second quarter of 2022 with 1,158,445 buyers.

Likewise, the seller’s database was also down by 11% with 711,262 in the second quarter of 2022.

Besides that, each person (buyers and sellers) can own multiple NFT wallets, which they use for buying, selling, and trading.

It’s usually recommended to have multiple wallets in the digital currency world.

Data revealed that as things settle down, there are around 150,000 for 110,000 sellers.

(NonFungible 2022)

FAQs

What Is the Most Expensive NFT Ever Sold?

Interestingly enough, CryptoPunk #9998 was the most expensive NFT ever sold, which happened in 2021. It was sold for $532 million in October 2021.

However, it’s an interesting story. The buyer bought it for himself (themselves).

The buyer transferred the NFT to three wallets, Wallet A, Wallet B, Wallet C. He bought it from Wallet B and then transferred it to Wallet A where it started.

The buyer did this because he wasn’t really buying it for himself, but via a flash loan.

The whole thing is complicated, but if you know how digital assets work and about flash loans, you know what happened. Yes. It’s legal.

What are NFTs?

NFT is short for non-fungible token, which is described as a unique digital asset type similar to cryptocurrency.

NFTs are also managed on a blockchain and can be any form providing the work is digital. For instance, artwork, video clips, memes, images, etc.

The difference between cryptocurrencies ad NFTs is that NFTs are distinct, have their own values, and cannot be exchanged or replaced with any similar thing.

What Are Some NFT Marketplaces?

OpenSea is the best, according to many reviews, but there are other NFT marketplaces from which to choose.

OpenSea, Myth Market, Rarible, and SuperRare are in the top four best NFT marketplaces for creators.

Who Are Some Top NFT Creators?

Beeple (Mike Winkelmann), Grimes, Maddogjones (Michah Dowbak), Hacktao, and Slimsunday (Mike Parisella) are some top selling digital artists and NFT creators in the space.

Is There an Issue with Environmental Impact in NFTs?

NFTs have come under scrutiny and are being criticized for issues related to negative environmental impact.

The process of minting and trading alone is known to consume huge amounts of energy.

In more positive news, platforms like Flow and Tezos have created more energy-efficient options over the conventional blockchain technology.

How Much of The NFT Market Is in Gaming?

Game NFTS account for about 22% of all NFT sales.

Data from the third quarter of 2021 shows that NFTs generated more than $10.7 billion in sales, of which 22% were from in-game sales.

This information tells us that there is a significant relation between non-fungible tokens and NFTs related to play-to-earn games.

What’s a Blockchain?

Whether you’re new to the cryptocurrency and NFT world or not, you need to know what blockchain means.

A blockchain is a digitally distributed, decentralized, public ledger that is hosted on a network.

Blockchains are used to facilitate the process of recording NFT or cryptocurrency transactions and for tracking assets via a business network.

Blockchain technology is global technology.

How Many Unique Wallets Traded in 2021?

In 2021, over 2.1 million distinct wallets traded NFTs. This was an increase over 2020 which accounted for 89,061 wallets.

Wallets are used for NFT transactions like buying, selling, holding, etc.

Conclusion

That’s all we have for NFT statistics in 2024 for now. We’ve discussed how volatile the NFT market is with its cryptocurrency-like fluctuations, etc.

We also have the data for the growth and ups and downs of the NFT market. Despite all this, NFTs saw a boost in popularity and made it into the mainstream arena.

The NFT market is still experiencing some growing pains, but overall, it has loads of possibilities for growth into this year and beyond.

As Gen Z and newer generations come of age, it’s likely we will see a rise in this industry.

There may still be fluctuations, but as the market calms down, things could stabilize making it easier to buy, sell, and trade.

In the NFT arena, knowledge of how to correctly buy, sell, and trade is crucial to avoid experiencing losses or being unable to recoup losses.

We expect that knowledge will become more easily accessible to the world.

We hope you have learned something from the key statistics and facts we shared and that you have a better understanding of the overall market.