Previously known as Facebook, Meta Platforms Inc. (Meta) is the new name and face for all of Mark Zuckerberg‘s aspirations. Mr. Zuckerberg initially expressed interest in the concept of the Metaverse when Facebook purchased the company Oculus back in 2014.

Meta Platforms Inc statistics show that the company is currently the owner of over 78 organizations and departments dedicated to various R&D programs. Throughout these developments, Meta Platforms Inc has grown to be an extremely influential corporation.

This article will provide more insight into more detailed Meta Platforms Inc statistics in 2024.

Post Contents

- 1 Key Meta Platforms Inc Statistics 2024

- 2 What is the Metaverse?

- 3 Meta Platforms Inc’s Acquisitions Statistics

- 4 Meta Platforms Inc Statistics: The Instagram Acquisition

- 5 Meta Platforms Inc Statistics About Revenue & Monthly Active Users

- 6 Statistics on Meta Platforms Inc’s Shareholders

- 7 Top Insider Shareholders

- 8 Top Institutional Shareholders

- 9 Conclusion

- 10 Sources

Key Meta Platforms Inc Statistics 2024

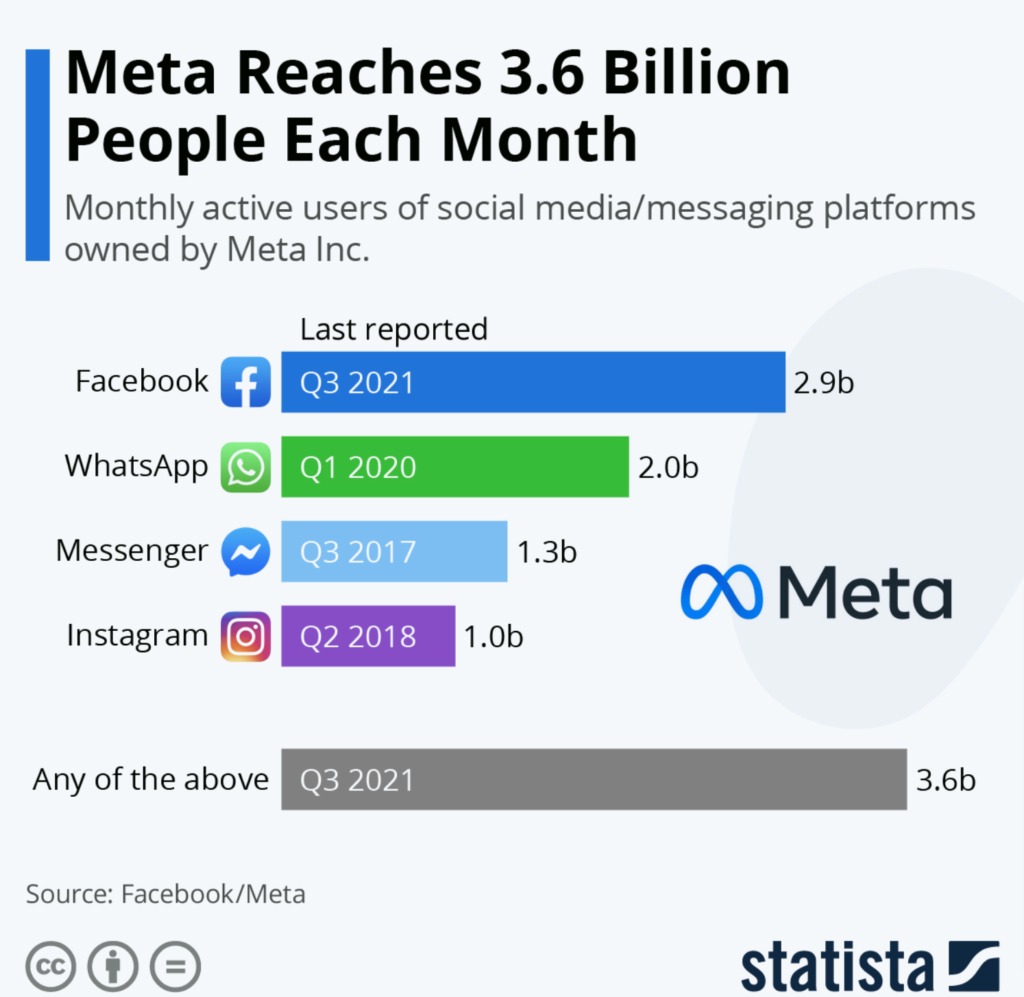

- Meta Platforms has 3.6 billion active users every month

- Mark Zuckerberg owns $398 million shares

- Meta Platforms Inc earned $104.8 billion in profit in 2021

- Meta paid $21 billion for WhatsApp

- Meta exposed 311,127 Australians in a data breach

- Meta has 3 million advertisers on its platforms

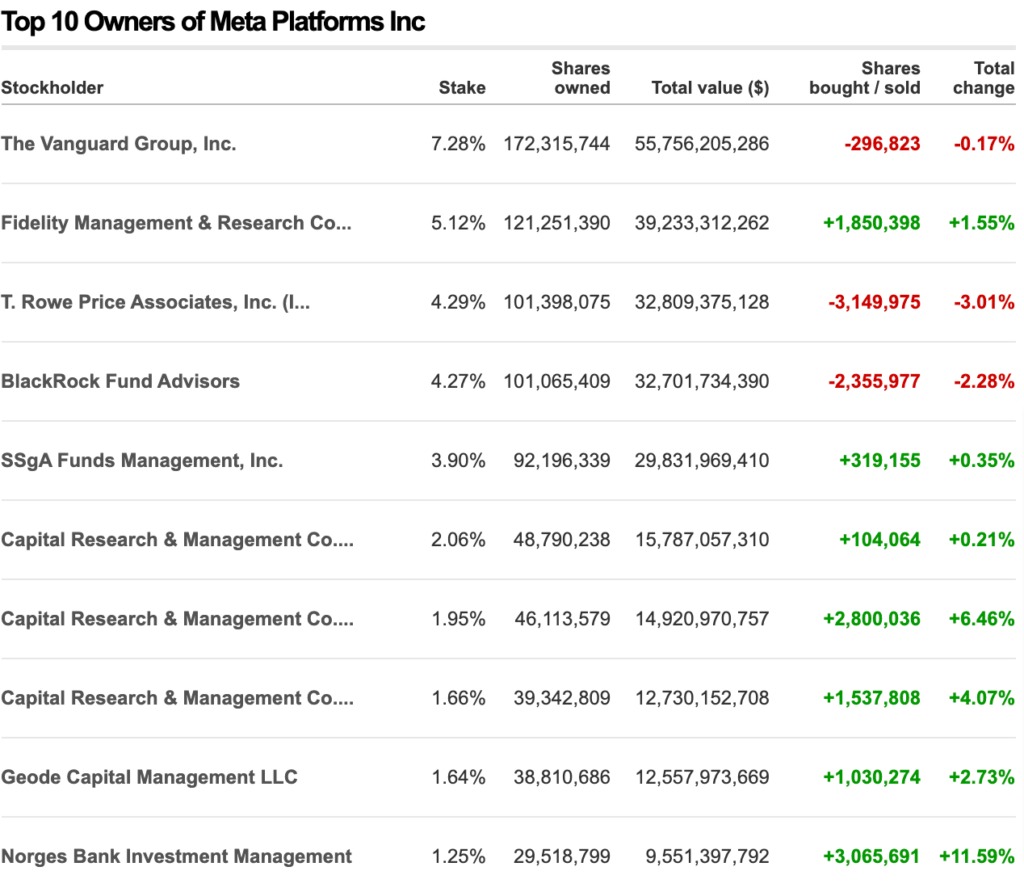

- Vanguard owns $22 billion worth of Meta shares

What is the Metaverse?

You may be familiar with VR but, the Metaverse is taking that whole experience to a new level. It’s a virtual world in which various products and services combine digital technology to provide endless opportunities for business and leisure integration.

However, there is no one description or notion behind this new technological environment and its potential opportunities.

Nevertheless, it’s labeled as “the next internet” with the goal of bridging our real and virtual realities. Mark Zuckerberg is convinced that the Metaverse will be ready for the world within 5-10 years.

According to some, the Metaverse’s uses are limitless and will change the way we communicate and handle business.

Throughout these developments, Meta Platforms Inc has grown to become one of the most recognized and influential corporations in a short amount of time.

Meta Platforms Inc’s Acquisitions Statistics

According to Meta platforms inc statistics, Meta didn’t get to where it is today entirely alone, and it’s not like they didn’t foresee potential competition throughout the years.

Since the inception of Facebook, Zuckerberg has acquired 78 businesses, and each one serves a purpose in Meta’s grand scheme.

Below you’ll find a breakdown pertaining to some of the most important acquisitions over the years.

Meta Platforms Inc Statistics: The Instagram Acquisition

Since the acquisition, because of its new look and concepts, Instagram flourished quickly and gained more attention from Facebook users in a short amount of time.

When Meta acquired Instagram, the photo and video sharing app wasn’t producing any revenue.

They only had 13 employees working for the company, and clearly, Zuckerberg had big plans for the application early on.

A younger demographic of users primarily utilized the Instagram platform to view and share photographs and brief video clips, and Meta recognized enormous corporate sales and marketing opportunities.

Not to mention the endless integrations we now see today. According to current statistics, each year, Instagram earns Meta Platforms over $20 billion.

Meta Platforms Inc Statistics: The WhatsApp Acquisition

Not long after the acquisition of Instagram, Zuckerberg set his sights on the popular messaging app WhatsApp, which had a growing and buzzing community of users.

The messaging app functions as a platform without ads that could be utilized in areas with little to no internet.

This is one of the key reasons why the application has grown in popularity on a worldwide scale. Recent statistics show that WhatsApp reached two billion registered users in the first quarter of 2020.

Experts estimate that Zuckerberg paid over one-tenth of the market value of Meta Platforms in 2014 to finalize the acquisition of the messaging app.

By the end of it, Meta decided to pay over $19 billion, which is an increase of $3.6 billion above the initial value.

This was due to the remuneration package for WhatsApp staff who stayed with Meta, as it shook things up for quite a few employees.

From here, Meta interacted with more individuals across the world, expanded its reach, and upset the notable competition in the process.

Meta Platforms Inc Statistics: The Oculus Acquisition

Oculus is a virtual reality technology company, and they were the initial driving force for Meta to dive into the VR technology space. In 2016, Oculus unveiled its first headset for virtual reality.

Regarding the available data, Meta spent more than $2 billion to purchase the virtual reality pioneer Oculus in 2014.

From here on, Mr. Zuckerberg began daydreaming about the concept of Metaverse and imagined the limitless possibilities that the company might develop with VR and AR technologies.

Although the Metaverse was a recent announcement, the idea has been in development for quite some time.

As the notion of the Metaverse matures, there will be many online areas where interactions between individuals will be much more multifaceted than they are now in everyday life.

It will just require updated technology to support it, which is another reason why we can expect full implementation to take up to a decade.

Furthermore, it intends to provide an economic sector comprised of both digital and physical aspects, with the ability to move digital assets between multiple Metaverse locations.

Aside from the role Oculus has played in the creation of the Metaverse, below are a handful of other acquisitions that have taken place over the years each playing their part under the Meta umbrella.

Meta Platforms Inc Statistics: Other Acquisitions

- Parse – $85 million

- LiveRail – $500 million

- Atlas Solutions – $50-$100 million

- Onavo – $100-$200 million

- tbh – $100 million

Meta Platforms Inc Statistics About Revenue & Monthly Active Users

Meta is one of the world’s fastest-growing companies, with a market valuation of over $960 billion as of October 1, 2021.

During its trial 12-month period, Meta earned $39.0 billion in net profits and generated $104.8 billion in earnings.

Furthermore, the total number of active users across Meta Platforms has topped 3.5 billion individuals worldwide on a monthly basis.

These numbers are expected to grow with the developments coming down the pipeline over the next decade, and Meta Platforms Inc. has no intention to slow down.

Statistics on Meta Platforms Inc’s Shareholders

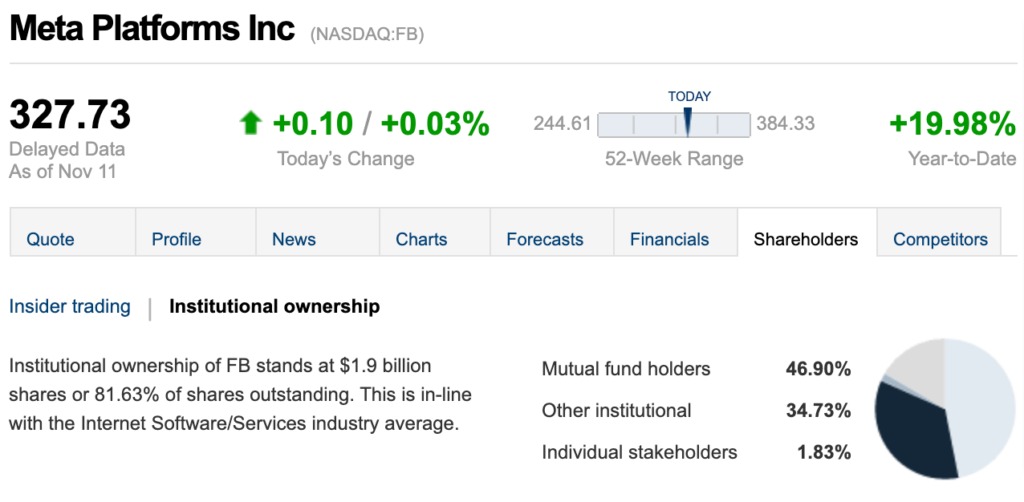

Meta is presently worth roughly $327 a share on the stock exchange. Members of top management in the company, directors on the board, those with a shareholding exceeding 10% of the total shares are usually referred to as ‘Insiders.’

These shareholders own shares in the form of direct ownership. The shares discussed in this section don’t pertain to the shares available through standard stock options.

Top Insider Shareholders

1. David Fischer

David Fischer owns 37,089 shares or about 0.001% of Meta’s total shares. He leads the marketing and sales team for Meta Platforms Inc .

Fisher formerly served as Vice President of Google’s online operations and revenue up until 2010.

In addition, Fischer was also the US Treasury Department’s deputy chief of staff, and he serves on the board of Alterra Mountain Co.

2. Michael Schroepfer

Schroepfer is the CTO at Meta Platforms Inc., and he’s in charge of the company’s technological development teams in fields such as AI and VR.

He holds 600,873 Meta shares, which is 0.02% of the business’s total shares, and has stated that he’ll be stepping down as Chief Technology Officer in 2022.

3. David Wehner

Wehner has been Meta’s CFO since 2014, overseeing the finance and information technology departments. David Wehner currently holds 22,521 Meta shares, accounting for less than 0.001% of the total available shares.

Top Institutional Shareholders

Individual investors who purchase 5% or more of a company’s stock are defined as institutional investors. Furthermore, these investors own over 65% of Meta Platform’s total shares.

More information about Meta Platforms’ top institutional investors, as well as how many shares they hold, can be seen below.

1. Vanguard Group Inc.

Vanguard is an investment management firm with around 440 low-cost conventional products and ETF’s. The Vanguard ETF (VOX), which has $ 4.6 billion in management, is one of numerous Vanguard funds that own shares of Meta Platforms Inc.

Meta is the most prominent position in this fund’s portfolio, accounting for around 17.1% of its invested assets.

2. Mark Zuckerberg

According to the 13G filing, Mark Zuckerberg owns 398 million shares of the company as of December 31, 2020.

The world’s eighth richest individual, Zuckerberg, is worth more than $67 billion regarding his total net worth.

His net worth fell by $9 billion in 2019 compared to 2018, yet he still ranks among the world’s top ten wealthiest individuals.

By far, Meta’s most significant stakeholder is Zuckerberg. As previously stated, he co-founded Meta, then known as Facebook, and has served as the company’s CEO.

3. Fidelity

In May 1967, Fidelity created the Fidelity Contrafund (FCNTX), and this fund provides capital market value by generally making investments in common equities based on certain growth factors.

Fidelity’s investments in Meta Platforms Inc. surpassed the market value of $12 billion. It currently holds 5.12% of the equities, and the figures are subject to rates in the market and can easily change.

The Fidelity group has about $119 billion in assets and an expense ratio between 0.85-0.90%, according to March 2021 figures.

Conclusion

These Meta Platforms Inc statistics for 2024 show that Zuckerberg and Meta Platforms Inc. will continue to propel the business and their worldwide vision forward.

Although the company has always boasted in its urge to bring the world closer together, Meta Platforms Inc. is just the start of a much broader mission beyond social networking.

There’s no doubt that the development of the Metaverse has many use cases that can benefit society.

Still, the unexpected problems we’ve seen social media and the internet unravel over the last 15 years, many want to prevent these same issues as much as possible within the Metaverse.