Cryptocurrency adoption is growing throughout the world.

More and more people are making these transactions.

These cryptocurrencies bypass state regulators, ensure privacy and provide unprecedented returns on investments.

However, despite all the hype, not many know about what this buzz is all about.

People are reluctant to go with it, questioning its authenticity.

This is where our guide comes into play as we will explore global trends, data and crypto statistics associated with this new form of digital currency in 2024.

Post Contents

- 1 Quick Crypto Statistics 2024

- 2 In-Depth Crypto Statistics 2024

- 2.1 Bitcoin Has Gained 177,500% Between 2012 and 2022

- 2.2 The Crypto Market Cap Is $1.76 Trillion

- 2.3 Bitcoin’s Market Cap Is $741 Billion

- 2.4 Daily Trading Volume for Crypto Has Increase to $93 Billion

- 2.5 There Were 15,000 Bitcoin ATMS in The World in 2021

- 2.6 Bitcoin Is the Most Popular Cryptocurrency Still

- 2.7 There Are 459 Spot Exchanges Around the World

- 2.8 The Ten Most Popular Crypto Exchanges Account for 79% of Daily Trading Volume

- 2.9 Worldwide Stablecoin Trading Volume Every 24 Hours if $77.86 Billion

- 2.10 Global Mining Income Is $20.1 Billion a Year

- 2.11 Worldwide Market Size of Digital Payments Is Move than 700 Billion Transactions

- 2.12 Worldwide Market Size of Bitcoin Transactions Is More than 120 Million

- 2.13 Crypto Theft Increased Between 2019 and 2020 by 160%

- 2.14 70 Million People Use Blockchain Wallets Around the World

- 2.15 A Crypto Social Media Post Gets Uploaded Every Two Seconds

- 2.16 Cryptocurrency Is Now Called Virtual Currency

- 2.17 More Males Know of Bitcoin than Females

- 2.18 67% of Millennials Consider Bitcoin as A Safe Haven Asset

- 2.19 Bitcoin Mining Uses Enough Energy to Power More than 10 Million Homes a Year

- 2.20 Bitcoin Consumes the Same Energy as All Global Data Centers

- 2.21 Carbon Emissions from Bitcoin Is More than Gold Mining

- 2.22 Electricity Costs Annually of Bitcoin Mining Are $4.4 Billion

- 2.23 The IRS Believes There Is a Massive Amount of Underreporting when It Comes to Bitcoin Gains

- 2.24 Just 802 People Reported Bitcoin-Related Transactions in 2015

- 2.25 Two Countries Have Banned Crypto as A Means of Payment

- 2.26 Most Countries Want to Tax Digital Currencies

- 2.27 Cryptojacking Is the Leading Cyber Threat

- 2.28 73% of Crypto Crimes in 2020 Were Seen as Fraud

- 3 What is Cryptocurrency?

- 4 How Many Cryptocurrencies Are There & What Is Their Worth?

- 5 Global Cryptocurrency Adoption in 2024

- 6 Crypto Users Over Time

- 7 Recent Crypto Trends

- 8 Industrial Crypto Trends

- 9 Future Trends of Cryptocurrency

- 10 Final Word

- 11 Sources

Quick Crypto Statistics 2024

- Bitcoin increased in value 177,500% between 2012 and 2022

- The crypto market cap is $1.76 trillion

- Crypto is the eighth biggest economy

- Bitcoin’s market cap is $741 billion

- As of 2021, there were almost 15,000 Bitcoin ATMS

- Bitcoin’s dominance makes it 42.2% more popular than the next crypto

- Global mining income is $20.1 billion a year

In-Depth Crypto Statistics 2024

Bitcoin Has Gained 177,500% Between 2012 and 2022

When Bitcoin was first launched on Coinbase in 2012, it costs $22 per USD for $1 million worth of the coin, but this increased more than 311,000% in just under a decade.

Bitcoin’s current price sits around $39,000.

This is obviously a huge increase on what it was just a few years ago, and shows that Bitcoin is still the dominant cryptocurrency.

The Crypto Market Cap Is $1.76 Trillion

Cryptocurrency statistics show that the total crypto market cap is more than $1 trillion, as a result of a dramatic increase in crypto popularity over the last few years.

This also means that the cryptocurrency market in general accounts for the eighth biggest economy in the world, which is saying something considering how new the industry as a whole still is.

Bitcoin’s Market Cap Is $741 Billion

This was calculated in 2022, and it’s actually a decrease from its market cap in 2021 which was $1.27 trillion.

If you wanted to purchase every Bitcoin that exists right now, then you would need more than $700 billion.

Stats like this one show that while Bitcoin has its ups and downs, it is still the juggernaut as far as the world of crypto goes.

Daily Trading Volume for Crypto Has Increase to $93 Billion

Statistics like this show that people are jumping on the crypto bandwagon, and doing so every day.

When looking at the general size of the market, you can see thanks to constant headline activity, cryptocurrencies currently trade in high volumes every day, as their individual market capitalizations continue to increase.

At the end of February 2022, the 24-hour trading volume of all cryptocurrencies around the world came to $93.4 billion.

At the end of 2021, the trading volume of all cryptocurrencies in the world was $130 billion.

Obviously, this means that it has decreased slightly, but this doesn’t mean that it isn’t going to increase again in the future.

There Were 15,000 Bitcoin ATMS in The World in 2021

Bitcoin ATMs have become more and more popular, and since 2015, they have increased exponentially, so now there are more than 15,000 Bitcoin ATMs in the world.

Bitcoin Is the Most Popular Cryptocurrency Still

Bitcoin is still the most popular cryptocurrency, despite the rise of other cryptocurrencies in the market.

Bitcoin’s dominance is more than 42.2%, and while it might fluctuate in value over the next few years, we don’t predict that any other cryptocurrency is going to come near to this kind of dominance.

There Are 459 Spot Exchanges Around the World

According to statistics, there are 459 spot exchanges for cryptocurrency around the world, with a total trading volume every 24 hours of $93.4 billion.

The Ten Most Popular Crypto Exchanges Account for 79% of Daily Trading Volume

Despite the fact that there are now tens of thousands of crypto currency exchanges out there these days vying for your attention, just like most other industries, only a few can come out on top.

This is why the top ten cryptocurrency exchanges around the world account for 79% of worldwide daily trade volume.

These include Binance, Venus, Upbit, and more.

Worldwide Stablecoin Trading Volume Every 24 Hours if $77.86 Billion

Cryptocurrency statistics will tell us that around the world, the total value of all Stablecoins, or tokens that are specifically linked to a stable asset, or a number of different assets like a Fiat currency, on average trade $77.86 billion every day.

Global Mining Income Is $20.1 Billion a Year

If you’re someone who is even slightly interested in the world of cryptocurrency, then you have probably been tempted at some point or another to try your hand at cryptocurrency mining.

And as you can see from statistics like this, there is definitely the opportunity to make some serious money and take a relatively big slice of the pie.

This number includes fees and rewards from mining Bitcoin sand we predict that this number is only going to increase as more cryptocurrencies launch through initial coin offerings, and the value of cryptocurrencies in general continues to increase.

Worldwide Market Size of Digital Payments Is Move than 700 Billion Transactions

Back in 2020, the total number of digital payments surpassed 700 billion, which translates to 14% growth over the last year.

Worldwide Market Size of Bitcoin Transactions Is More than 120 Million

Again in 2020, the complete number of Bitcoin payments per year was more than 120 million, which back then was a small percentage of total digital payments but indicates that Bitcoin was still growing in popularity.

Crypto Theft Increased Between 2019 and 2020 by 160%

According to statistics, another darker side of the cryptocurrency industry is cryptocurrency theft.

Between 2019 and 2020, the frequency of crypto theft increased by 160%.

This also indicates a market that is maturing.

70 Million People Use Blockchain Wallets Around the World

A cryptocurrency wallet, or a blockchain wallet, is a system, medium, or device where you can store your cryptocurrency safely.

This wallet is going to not only store your cryptocurrency information, but it is also going to encrypt your data, and let you log in with credentials so that you can protect your cryptocurrency assets from hackers, and theft.

As you can see from statistics like these, almost 17 million people around the world use a blockchain wallet.

What’s really interesting about crypto is that roughly 1/3 of Nigerians use cryptocurrency, while one in five people in the Philippines and Vietnam do as well.

A Crypto Social Media Post Gets Uploaded Every Two Seconds

We think it’s safe to say that based on statistics like these that the world of cryptocurrency is pretty exciting for a lot of people and garners a lot of attention.

In fact, between 14,000, and 32,000 tweets appear every day on Twitter related to cryptocurrency.

We think that this number is only going to increase.

Cryptocurrency Is Now Called Virtual Currency

Back in 2013, cryptocurrency was definitely the most popular term to explain and describe digital currency, but these days, cryptocurrency seems to be on its way out, with virtual currency taking over.

More Males Know of Bitcoin than Females

Another crypto statistic that’s really interesting is that more males are interested in Bitcoin than females.

Surveys conducted around the world revealed that Bitcoin awareness among males and females in America differed slightly.

As far as males were concerned, 78% of survey participants said that they were aware of Bitcoin.

This is compared to just 71% of females.

It isn’t the biggest margin, but it does indicate that males are more aware and potentially more interested in cryptocurrency than females.

67% of Millennials Consider Bitcoin as A Safe Haven Asset

Back just a few years ago, the biggest safe haven asset according to the older generations and investment experts was gold.

However, these days, cryptocurrency adoption statistics indicate that it would appear that millennials are considering Bitcoin as a safe haven asset.

Bitcoin Mining Uses Enough Energy to Power More than 10 Million Homes a Year

Stats indicate that when it comes to Bitcoin mining, a lot more energy is used to power the process than you might think.

In fact, Bitcoin mining uses enough energy to power more than 10 million homes a year.

Bitcoin Consumes the Same Energy as All Global Data Centers

According to Bitcoin statistics, it would appear that Bitcoin mining is a massive user of energy, and based on the current market value of Bitcoin, it is estimated that the process of mining Bitcoin amounts to roughly the same amount of energy that is consumed by all data centers around the world.

Carbon Emissions from Bitcoin Is More than Gold Mining

Despite the fact that millennials believe Bitcoin to be the new safe haven asset compared to gold, Bitcoin mining is actually worse for the environment than gold mining is.

Bitcoin mining produces more global carbon emissions than mining for gold does.

Bitcoin mining produces 81 million metric tons of CO2 a year.

Electricity Costs Annually of Bitcoin Mining Are $4.4 Billion

It isn’t only CO2 emissions that are affected by Bitcoin mining.

It also takes a lot of electricity to mine the Bitcoin as well.

More than $4.45 billion gets spent on electricity costs for mining Bitcoin every year.

The IRS Believes There Is a Massive Amount of Underreporting when It Comes to Bitcoin Gains

If you are someone who doesn’t really know that much about Bitcoin mining, and you are trying to make a profit as quickly as possible, then you might be tempted to turn a blind eye when it comes to tax season.

The thing about Bitcoin mining and cryptocurrency mining in general is that tax regulations are still being developed, and they are of course different in every country.

In 2015, the IRS served a summons on Coinbase, which is the biggest exchange for investing in Bitcoin.

They did this because they believed that there were a large number of American individuals using their platform to exchange Bitcoin that hadn’t reported their activity on their tax returns.

As far as the IRS goes, there is a huge amount of underreporting when it comes to gains in Bitcoin.

Just 802 People Reported Bitcoin-Related Transactions in 2015

It would appear based on stats like this that the IRS is probably correct.

Back in 2015, just 802 people reported Bitcoin-related transactions.

There is no doubt that there were hundreds if not thousands more people investing in and trading Bitcoin.

Two Countries Have Banned Crypto as A Means of Payment

Stats indicate that when it comes to using cryptocurrency as a means of payment, the regulations are different depending on where you are located in the world.

What’s really interesting is that there are two countries in the world that have actually banned cryptocurrency as a means of payment, and these are Indonesia, and Ecuador.

Most Countries Want to Tax Digital Currencies

You might be surprised to learn that there are some countries out there that don’t see the need to tax cryptocurrencies, but the majority of them do.

Most countries take the position that creating a digital currency through mining constitutes a taxable event.

They also believe that disposing a virtual currency through a transaction is a taxable event.

Cryptojacking Is the Leading Cyber Threat

There are a number of different ways that criminals try to mine Bitcoin illicitly, and one of those ways is through cryptojacking.

Cryptojacking is when someone uses a machine to mine cryptocurrency without the owner’s knowledge. As you can see from this crypto statistic, this is quickly becoming the biggest cyber threat in the world.

In 2020, the value of global cryptocurrency theft was $513 million, which is a big increase from $371 million in 2019.

73% of Crypto Crimes in 2020 Were Seen as Fraud

Currency fraud plays a huge part in the illicit side of cryptocurrency investment, with 73% of cryptocurrency crimes in 2020 seen as fraud.

What is Cryptocurrency?

Cryptocurrency or crypto is a firm of digital currency that you can use to purchase services and goods.

However, it uses an online ledger with strong cryptography for securing your online transactions.

People take an interest in these unregulated currencies to trade on profits.

Sometimes the speculators are driving the prices high, so there is a good chance that people may earn higher profits.

The most popular of all these cryptocurrencies is bitcoin.

And it has had some volatile price movements throughout the years.

During April 2021, it skyrocketed to USD 65,000, and right in the next month, it lost almost half of its value.

In October 2021, the price skyrocketed again, and bitcoin reached its all-time high to USD 66,000 before retreating slightly.

Many companies recently have issued their currencies which are commonly known as tokens.

You can trade these tokens specifically for the services and goods that that particular company provides.

You can think about these tokens as casino chips or arcade tokens that you use in a specific casino.

Moreover, you can exchange real currency to crypto for accessing a company’s offered commodities.

Cryptocurrencies use blockchain, which is a technology that these digital currencies run on.

It is a decentralized technology spread throughout many computers that can manage and record these crypto transactions.

So, blockchain might be a decentralized technology, but it is pretty secure.

How Many Cryptocurrencies Are There & What Is Their Worth?

According to CoinMarketCap, more than 13,000 cryptocurrencies are active in the market today.

Still, these digital currencies are increasing by raising money using ICOs (initial coin offerings).

As of October 22, 2021, the total value of all cryptocurrencies was over USD 2.5 trillion.

However, the number has slightly fallen from USD 2.6 trillion a few weeks earlier.

Moreover, the total value of all bitcoins, the most popular crypto out there, is around USD 1.2 trillion.

The ten best cryptocurrencies by market capitalization are listed as follows.

These are the numbers taken on October 28, 2021.

| Cryptocurrencies | Market Capitalization |

| Bitcoin | USD 1.1 trillion |

| Ethereum | USD 497.6 billion |

| Binance Coin (BNB) | USD 81 billion |

| Tether | USD 70.1 billion |

| Cardano | USD 66.4 billion |

| Solana | USD 59 billion |

| XRP | USD 49.7 billion |

| Polkadot | USD 41.6 billion |

| Dogecoin | USD 41.2 billion |

| Shiba Inu | USD 36.5 billion |

Global Cryptocurrency Adoption in 2024

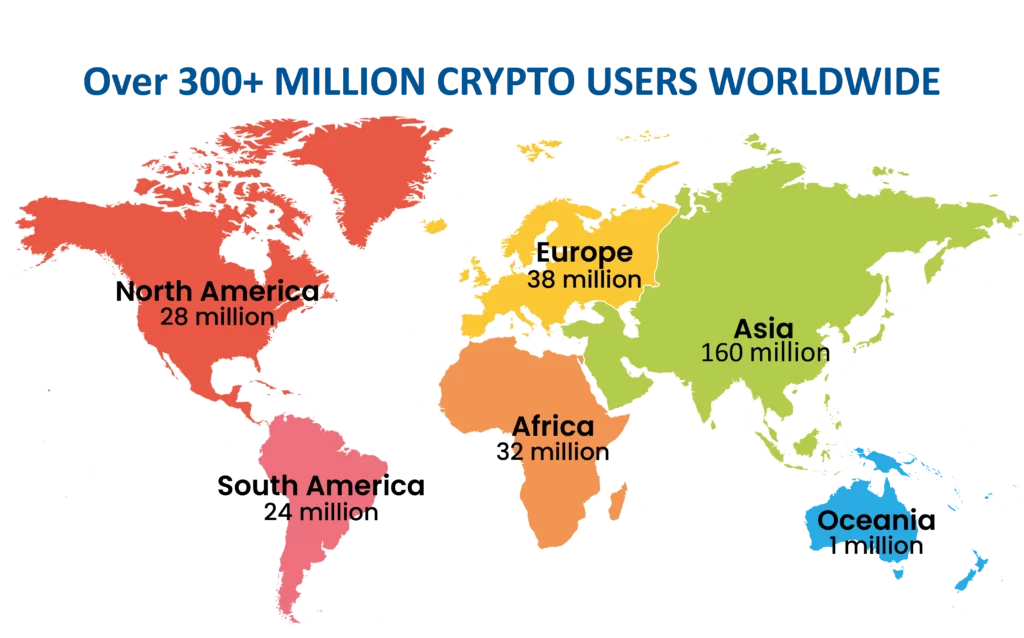

Tripe A, a well-reputed crypto payment company, estimated the global ownership would grow by 3.9 percent in 2021.

There are over 300 million crypto owners throughout the world.

More than 18,000 businesses have adopted and are already accepting cryptocurrencies as payments.

Here are some more interesting facts about global cryptocurrency adoption:

- Bitcoin market capitalization crossed USD 1 trillion in February of 2021.

- Bitcoin alone constituted 66 percent of the overall market capitalization of crypto in 2020.

- India tops the list of most cryptocurrency owners that reach over 100 million. The USA is on the second spot with 27 million, and Nigeria is on the third spot with 13 million crypto owners.

- Almost 80 percent of the owners are males, while over 20 percent are females.

- 58 percent of the total global owners of crypto are under 34. While more than 82 percent at least have a Bachelor’s degree.

- More than 36 percent of the total owners of crypto have an annual income of more than USD 100,000.

Crypto Users Over Time

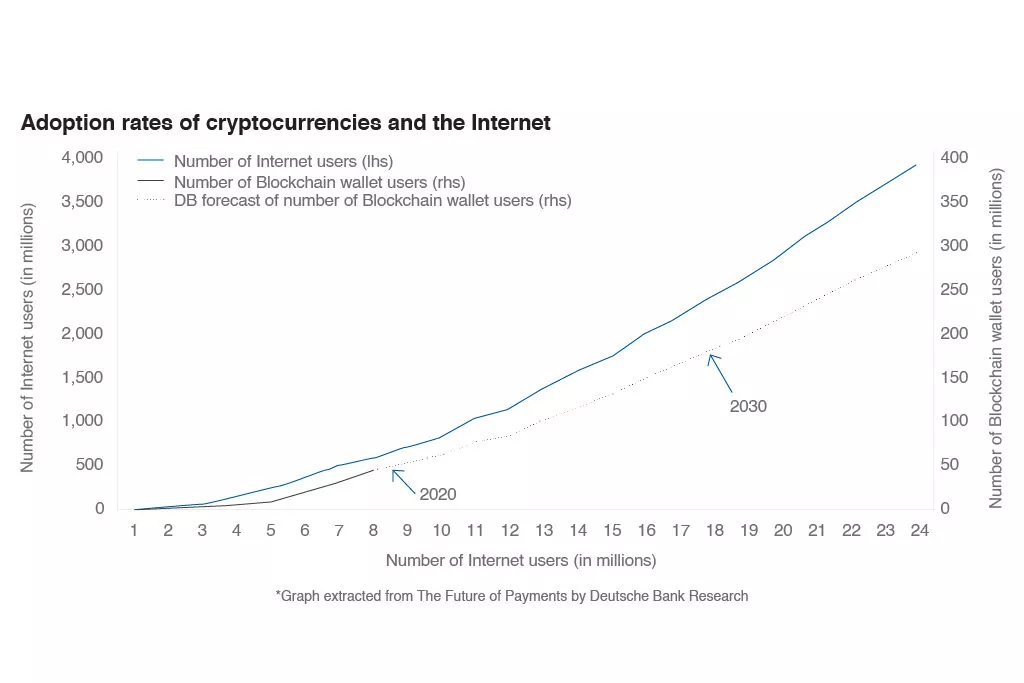

From 2012 to 2021, the price of the single biggest cryptocurrency, bitcoin, has increased more than 540,000 percent.

It is a massive number considering the small time frame that it took for the achievement.

Digital currency has an annual growth rate of over 270 percent in the year 2020 alone.

The crypto market is expected to grow with a compound growth annually at 56.4 percent from 2019 to 2025.

As you can see in the graph, the numbers are climbing fast.

There is a significant trend that you can see here.

With a noticeable increase of internet users throughout the globe, the number of blockchain users is increasing too.

Recent Crypto Trends

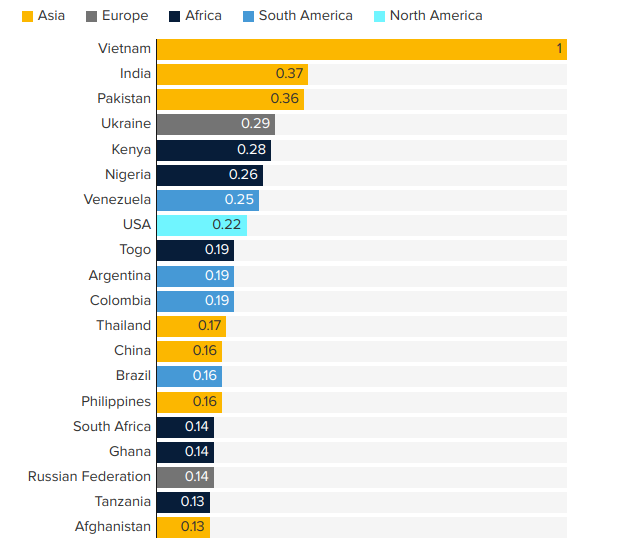

Closer observation will show that the numbers that we have just described are changing pretty fast.

This is due to the global adoption of cryptocurrency in the last year.

It has increased by over 880 percent, with Vietnam, India, and Pakistan gaining significant leads in the ranking according to the Chainalysis Index.

This index ranks 154 countries based on the metrics, including P2P (peer-to-peer) exchange trading volume instead of gross transaction volume.

The gross truncation volume favors the developed nations with higher levels of institutional and professional crypto purchases.

And this trend is not only limited to individual users.

Many international companies have started accepting crypto payments too.

Companies like Microsoft,

, Wikipedia, Overstock, and American Red Cross were the early adopters of this digital currency. Quickly after, Subway Save the Children, NameCheap, and Galactic joined them.

And the numbers have been growing ever since.

More recently, brands like Burger King, KFC, AT&T, Expedia, BMW, Crate&Barrel, Booking.com, Coca Cola, PayPal, Starbucks, and Twitch have also jumped the bandwagon.

Industrial Crypto Trends

Significant effects of crypto are visible across all sectors.

But, some sectors have seen more of it than others.

Retail, luxury, gaming, and remittance are the few that the growth of crypto has most influenced.

Here are some stats to consider in this regard:

Retail

- More than 40 percent of the customers that are paying through cryptocurrencies are new to their merchants. So newer customers are more inclined towards paying in crypto.

- The number of transactions paid using crypto on many eCommerce sites has grown by 12.5 percent each year. Therefore, more and more customers prefer to pay through cryptocurrencies each year.

- The merchants who accept digital currencies have seen a return on investment of over 320 percent. Hence, more and more merchants are using digital currencies for increased profits.

Luxury

- These digital currencies protect luxury brands against the risk of grey or counterfeit markets.

- These brands can use cryptocurrencies for the creation of exclusive experiences and limited items. Only crypto owners can go for these limited editions items and unique experiences. Therefore, they are also promoting the use of cryptocurrencies due to their increased profits.

Remittance

- Cross-border transfer and digital remittances have almost reached USD 96 billion in the year 2020. It means that already there is a scope of using digital currencies for these transfers.

- Almost 16 percent of remitters are already using digital currencies to transfer their money cross-borders. So, people are already using this form of currency to send their money to other countries.

- One of the primary reasons some people are already using digital currencies to transfer their money across borders is that crypto is 388 times faster and 127 times much cheaper than conventional remittance methods.

Gaming

- Almost 42 million gamers will have cryptocurrency in the year 2020. With the gaming industry flourishing as ever, this number is expected to grow at a serious rate.

- The estimated market revenue of the crypto gaming industry is USD 321 million in the year 2020. And this number is estimated to grow at a significant rate in the coming years, with more and more gamers joining in.

- The Asia-Pacific region has seen the most growth recently, with the highest crypto ownership of 22.6 million gamers.

Future Trends of Cryptocurrency

According to a study, the cryptocurrency market will grow three times by 2030.

Allied Market Research generated this report.

As per its assessment, the annual growth from 2021 to 2030 will be 12.8 percent per annum.

The overall market share will be USD 4.94 billion in the year 2030.

It was poised at USD 1.49 billion in 2020.

The primary drivers will be increasing demand for global remittances and better transparency within international payment systems.

Over two-thirds of the industry size in 2020 came from the cryptocurrency mining segment.

And experts estimate it to retain its dominant position throughout the future decade.

But the fastest growth is anticipated in the transaction segment, with more and more individuals and corporations engaging in cryptocurrency.

As per the report, the fastest growing industry sector will be Asia-Pacific due to the increased competition from growing exchange numbers.

According to another study, again by Allied Market Research based on the crypto-asset management market, this market will grow to USD 9.4 billion in the year 2030.

It was USD 670 million in 2020.

This study also highlighted that the Asia-Pacific region would be at the forefront of global growth due to more crypto mining enterprises in these locations.

These enterprises will drive the demand for asset management services and products to assist their business processes.

Final Word

Without a doubt, cryptocurrencies are here to stay.

More and more individuals and corporations are inclining to use this form of currency to make their transactions faster and more secure.

The global crypto market is increasing steadily without showing any signs of stopping any time soon.

Hence, it is true to say that digital currencies are an inevitable future.

Millions of people and thousands of businesses are already using it.

If you are looking to increase your return on investment trifold, you should start dealing in crypto too.